Helpful Summary

- Overview: We explore the best insurance contract management software, highlighting key features, pros, and cons to help you find the tool that best suits your business needs.

- Why trust us: We’re the e-signature tool of choice for 61,000+ businesses across a variety of industries, so you can trust our expertise in digital document management.

- Why this is important: Implementing the right insurance contract management software can lead to significant efficiency gains, improved compliance, and enhanced risk management.

- Action points: Our top picks are Signwell, Agiloft, Updraft, DealHub, PandaDoc, ContractWorks, Contract Hound, ContractZen, Docusign, LinkSquares, Ironclad, Icertis Contract Intelligence, Conga Contracts, and ContractSafe.

- Further research: Check out the SignWell blog for more insights into digital document management and contract automation.

Looking for the Best Insurance Contract Management Software?

Insurance agents, agencies, and carriers have unique needs when it comes to managing their contracts. With the constantly changing landscape of insurance regulations and policies, having a reliable and efficient contract management system is crucial.

Insurance contract management tools can reduce the burden of manual admin work and improve overall efficiency. And in this SignWell guide, we’re going to introduce you to some of the best insurance contract management software in the market.

But first…

Why Listen To Us?

At SignWell, we’ve helped more than 61,000 businesses simplify their digital document management processes with intuitive e-signing. Our approach is simple—we focus on helping our customers save time, resources, and money by making it as fast and easy to get contracts signed and executed.

What is Insurance Contract Management Software?

Insurance contract management software is a tool built to help insurance companies and agents manage their contracts effectively. How it works depends on the specific software, but typically it will offer features to help streamline different stages of the contract management process.

What are these features? Here’s an overview of some common ones:

- Templates and clause libraries: These are pre-designed contract templates and standard clauses that can be easily customized and reused, saving time and ensuring contract consistency.

- Document storage: This feature allows users to securely store all related documents in one central location, making it easier to access and review them as needed.

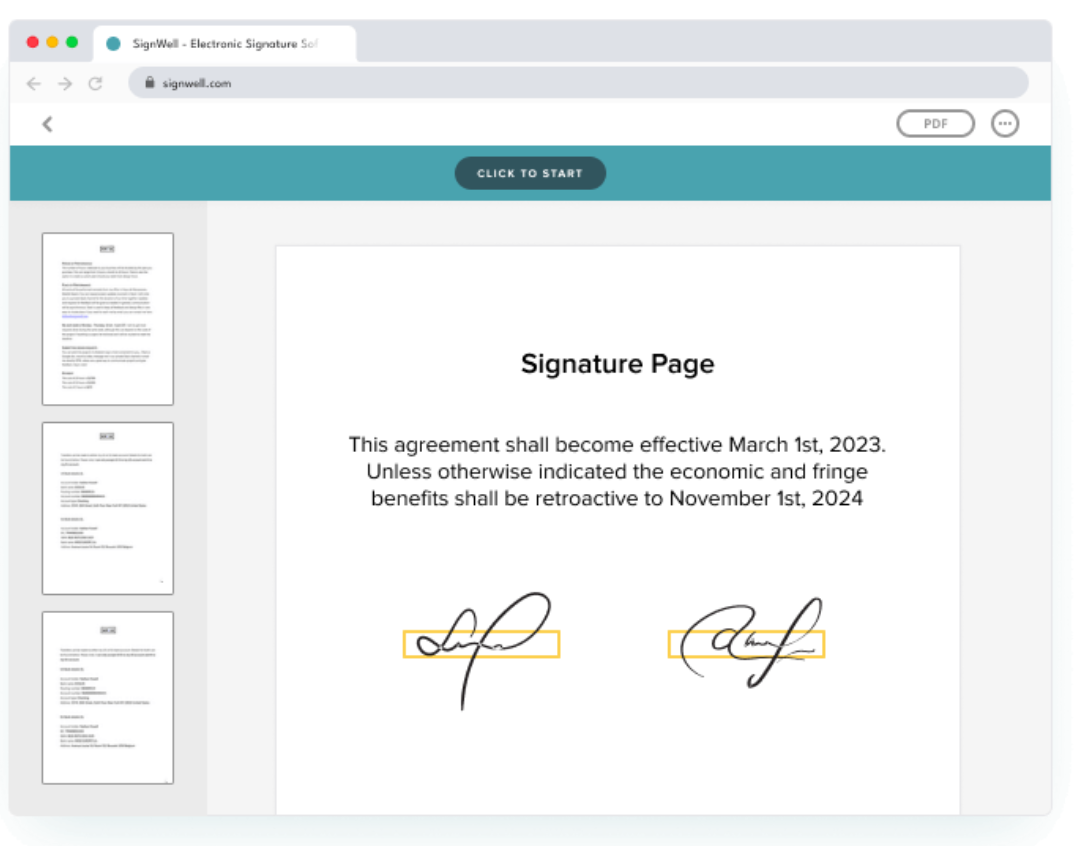

- E-signatures: The ability to electronically sign documents eliminates the need for printing, signing, scanning, and mailing physical copies. This saves time and money while also reducing paper waste.

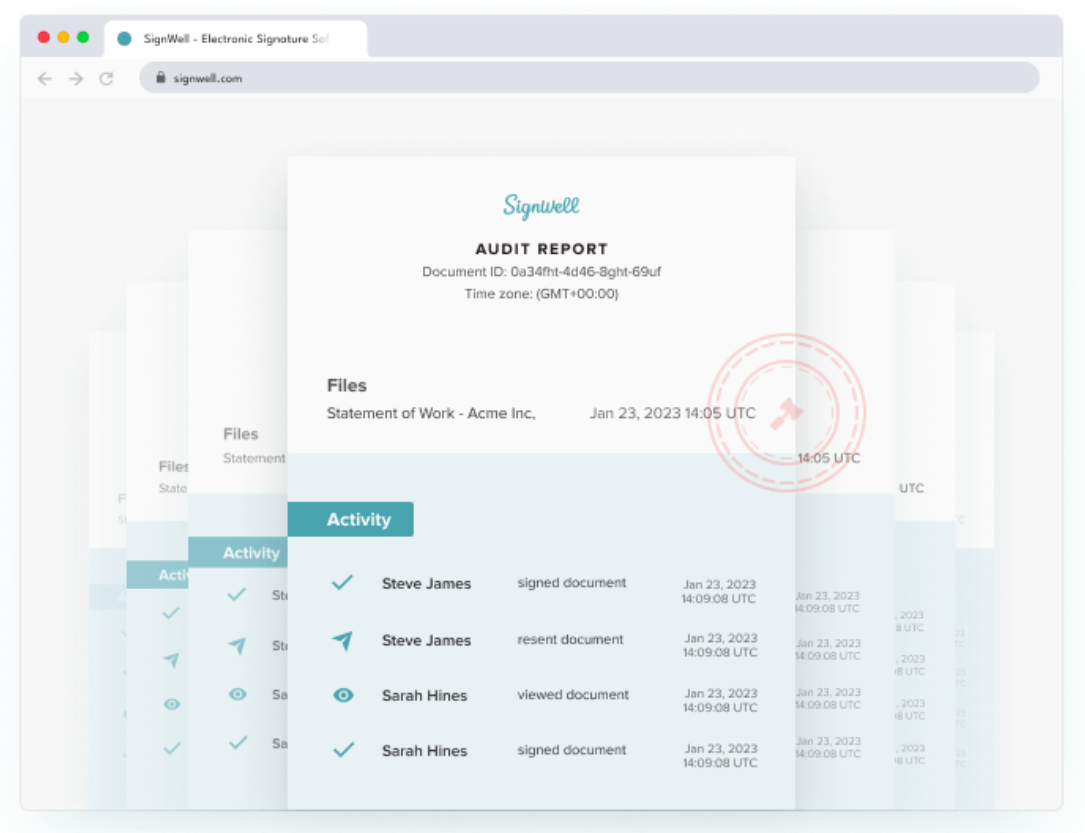

- Audit trail: A comprehensive audit trail feature tracks all changes made to a document, providing transparency and accountability throughout the contract management process. This can be useful for compliance purposes or in case of any disputes.

Additionally, you’ll also often find features like:

- Automation

- Reporting and analytics

- Collaboration tools

SignWell is a great example of an insurance CLM tool that focuses more on collecting legally binding electronic signatures quickly and securely. Other tools focus more on aspects like risk analysis, contract drafting, and compliance monitoring.

The kind of tool you choose should depend on what you need it to do.

Benefits of Using Insurance Contract Management Software

- Improved Efficiency: Contract management software streamlines the entire contract lifecycle, from creation and negotiation to signing and renewal, saving time and reducing manual errors.

- Enhanced Compliance: With features like automated alerts and reminders, contract management software helps ensure that contracts adhere to regulatory requirements and internal policies, reducing the risk of non-compliance.

- Increased Visibility: Contract management software provides centralized access to all contracts and related documents, offering stakeholders real-time visibility into contract status, key dates, and performance metrics.

- Better Risk Management: By enabling proactive risk identification and mitigation through features like customizable workflows and automated risk assessments, contract management software helps organizations mitigate contractual risks and avoid costly disputes.

- Cost Savings: Contract management software eliminates the need for manual processes, paper-based documentation, and unnecessary delays, resulting in cost savings associated with increased productivity, reduced administrative overhead, and minimized legal risks.

Criteria to Consider When Choosing an Insurance Contract Management Software

Customization and Flexibility

Consider the level of customization and flexibility required when selecting an insurance contract management software. When evaluating software options, keep in mind the following key points:

- User Interface Customization: Ensure the software allows you to tailor the interface to your specific needs and preferences.

- Workflow Flexibility: Look for a system that can adapt to your unique workflows and processes.

- Integration Capabilities: Choose software that can easily integrate with your existing systems and tools for seamless operation (more on this below).

- Scalability: Opt for a solution that can grow with your business and accommodate future changes efficiently.

Comprehensive Contract Lifecycle Management

Ensure your insurance contract management software provides a comprehensive approach to managing the entire contract lifecycle.

Look for features that cover contract creation, negotiation, approval, execution, and renewal. A robust system should offer customizable workflows, automated alerts for key dates, and easy access to contract templates.

Ease of Use and Adoption

When selecting an insurance contract management software, assessing its ease of use and adoption is crucial for smooth integration and user acceptance. Opt for a platform that offers intuitive navigation and a user-friendly interface.

Integration Capabilities

To seamlessly integrate an insurance contract management software into your operations, carefully evaluate its integration capabilities to ensure compatibility with your existing systems and processes.

Here are some key factors to consider:

- API Support: Check if the software offers robust API support for easy integration with other tools.

- Third-Party Integrations: Look for software that easily integrates with common third-party applications used in the insurance industry.

- Data Import/Export: Ensure the software allows seamless import and export of data in various formats.

- Customization Options: Choose a software that provides customization options to tailor the integration process to your specific needs.

Best Insurance Contract Management Software

- SignWell

- Agiloft

- Updraft

- DealHub

- PandaDoc

- ContractWorks

- Contract Hound

- ContractZen

- DocuSign

- LinkSquares

- Ironclad

- Icertis Contract Intelligence

- Conga Contracts

- ContractSafe

1. SignWell

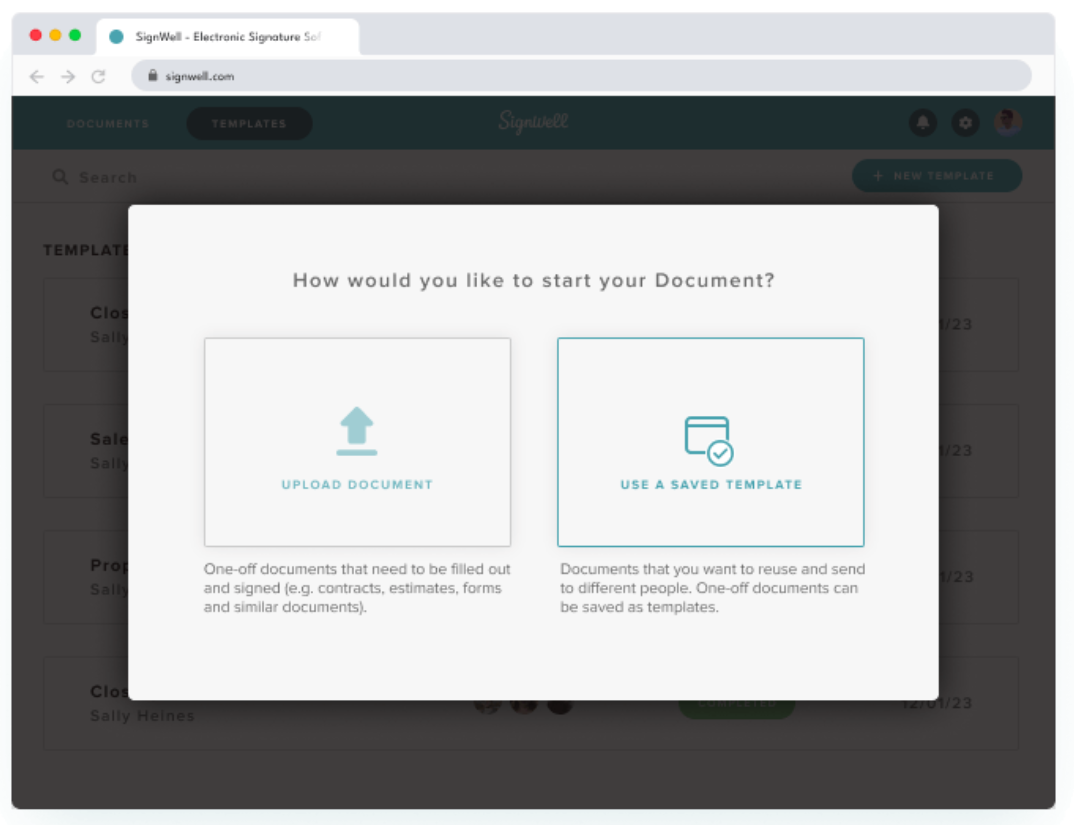

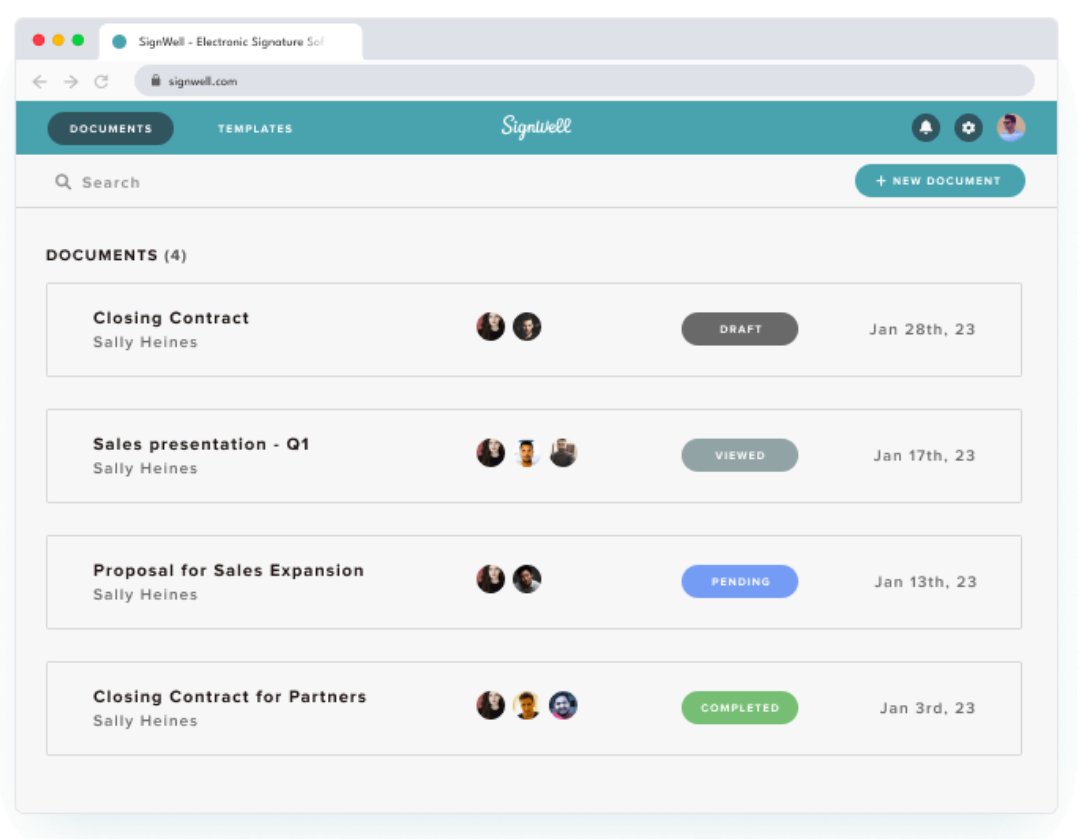

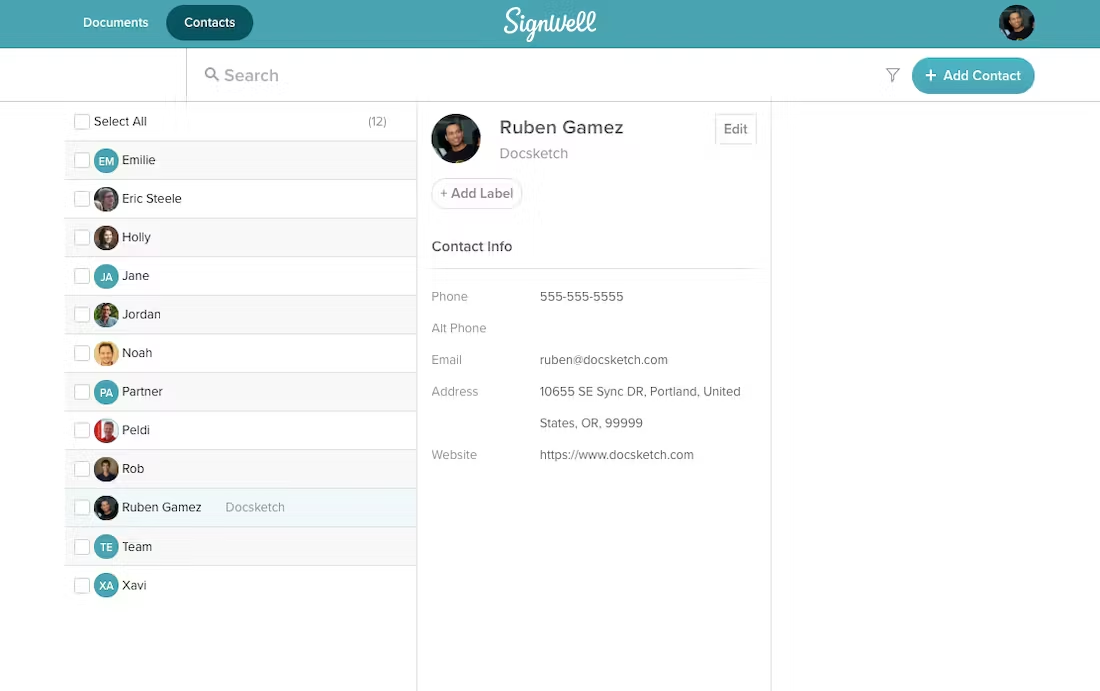

SignWell is an electronic signature tool designed to simplify and streamline the document signature process. We stand out due to the simplicity and speed of our e-signing workflow—you can set up and send a contract for signing in minutes, complete with data validation rules, required fields, and more.

For insurance professionals, we offer powerful features like signing orders, reusable templates, and document tracking. Our integration capabilities also allow for seamless data flows between your existing CRM and workflow tools.

Key Features

- Legally Binding E-Signatures: Collect legally binding e-signatures that are compliant with ESIGN, eIDAS, UETA, HIPAA, SOC 2 Type 2, and more.

- E-Signature API: Add e-signature functionality to your own software or application with our easy-to-use API.

- Drag-and-Drop Editor: Set up documents quickly by dragging and dropping signature, text, date, initial, and checkbox fields onto your contracts.

- Contract Templates: Save common documents as templates to reuse, saving hours of setup time.

- Automatic Reminders: Get signatures faster by automatically prompting signatories with reminders at set intervals (or manually when you choose).

- Signing Orders: Choose who signs first, second, and so on to ensure a smooth signing process.

- Audit Trail: Keep track of all document activity and changes each party makes for accurate record-keeping.

- Integrations: Connect SignWell with over 5,000 apps and software for seamless document management.

Pricing

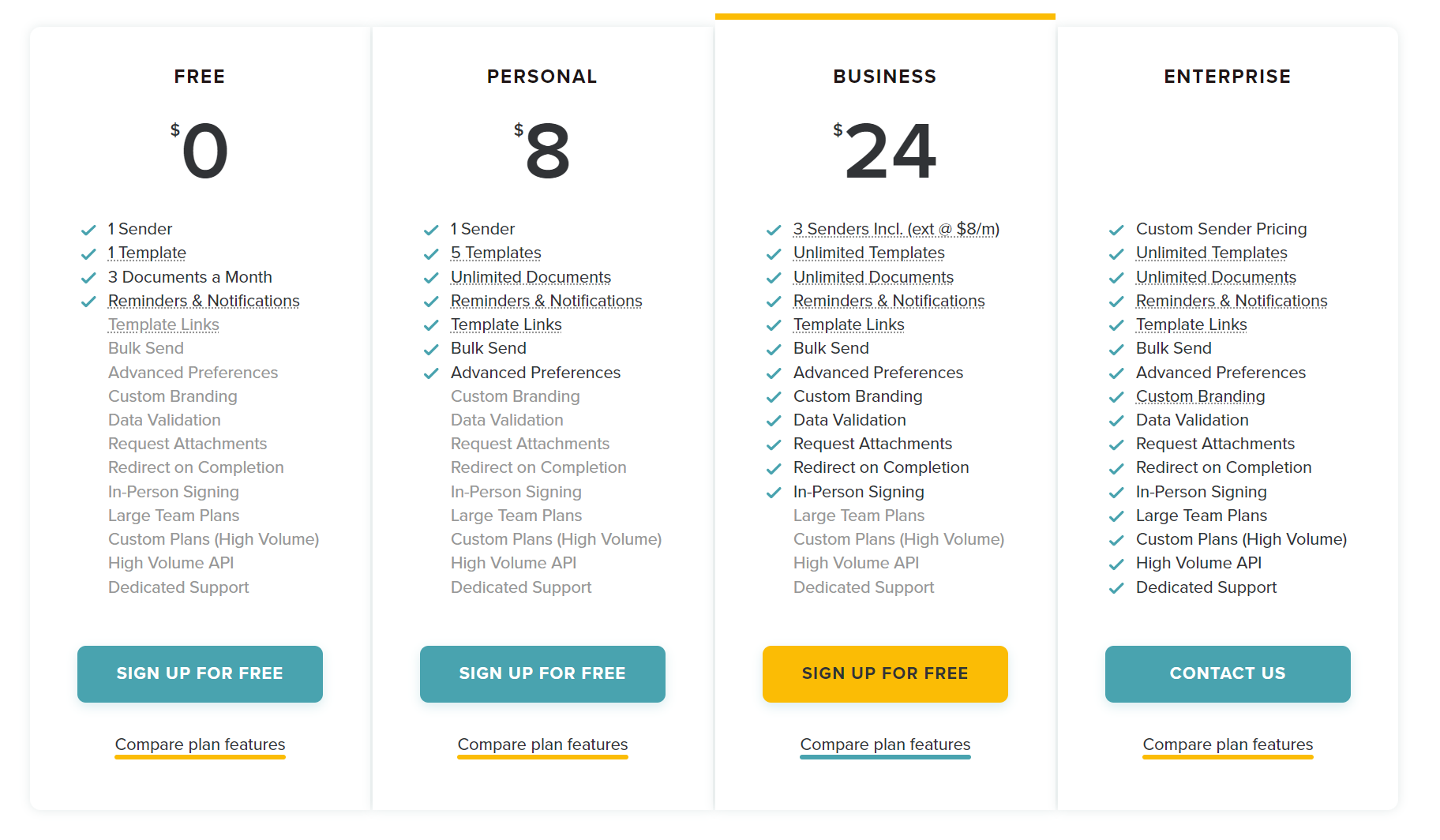

We offer a free plan that allows one sender to send and sign up to 3 documents each month. It’s a great way to test SignWell out, even if the average insurance agent will need to send more than 3 documents per month.

For those who require more usage, we offer three paid plans:

- Personal ($8/month)

- Business ($24/month for 3 senders + $8/month per additional sender)

- Enterprise (custom)

Higher-tier plans offer advanced features like data validation, access to our high-volume API, and in-person signing.

API Pricing

Our API is pay-as-you-go—you’ll only be charged for what you use, with no hidden fees. Your first 25 documents are free each month, and we offer volume-based discounts for larger usage.

Pros & Cons

Pros

- Competitive pricing with a free plan available

- User-friendly interface

- Offers a seamless electronic signature process

- Automated alerts

- Document tracking

- Secure and compliant with major legal standards

Cons

- No native document editing capabilities

2. Agiloft

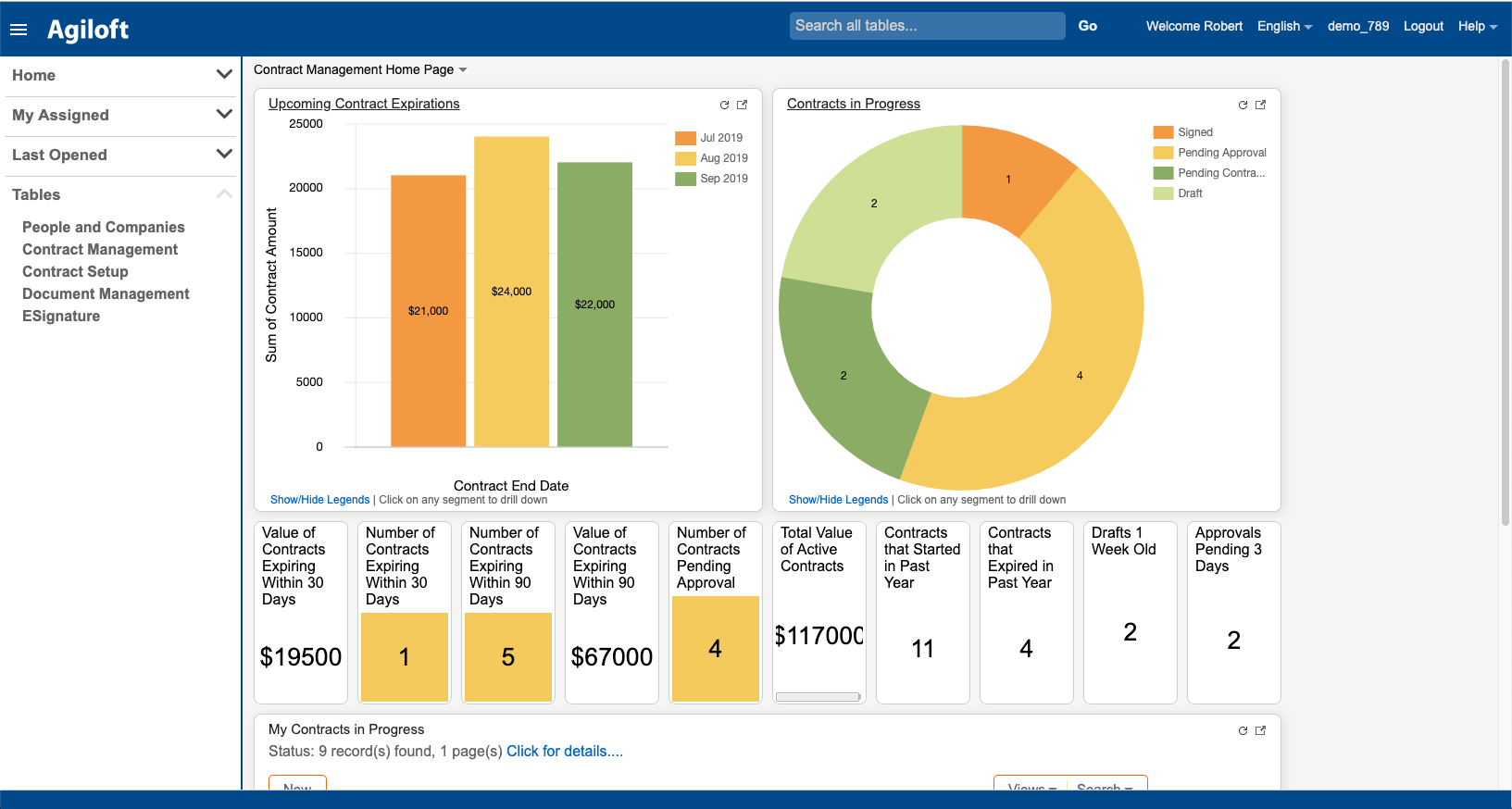

Agiloft is a CLM tool that supports insurers across the entire contract lifecycle, including contract authoring, negotiation, execution, and management. The platform offers a flexible and customizable solution to meet the unique needs of insurance companies.

Key Features

- Reporting & dashboards: Get high-level overviews of contract status, performance, and risk.

- Integrated e-signature: Easily execute contracts with built-in electronic signature capabilities.

- Automated workflows: Streamline your operations and increase efficiency by creating automated workflows without code.

- Advanced search: Find exactly what you’re looking for with metadata search capabilities.

Pricing

Contact their sales team directly for a personalized quote.

Pros & Cons

Pros

- Advanced functionality

- Scalable customization

- Fair pricing

- Strong customer service

- Mobile-friendly

- Automated tasks

Cons

- Learning curve

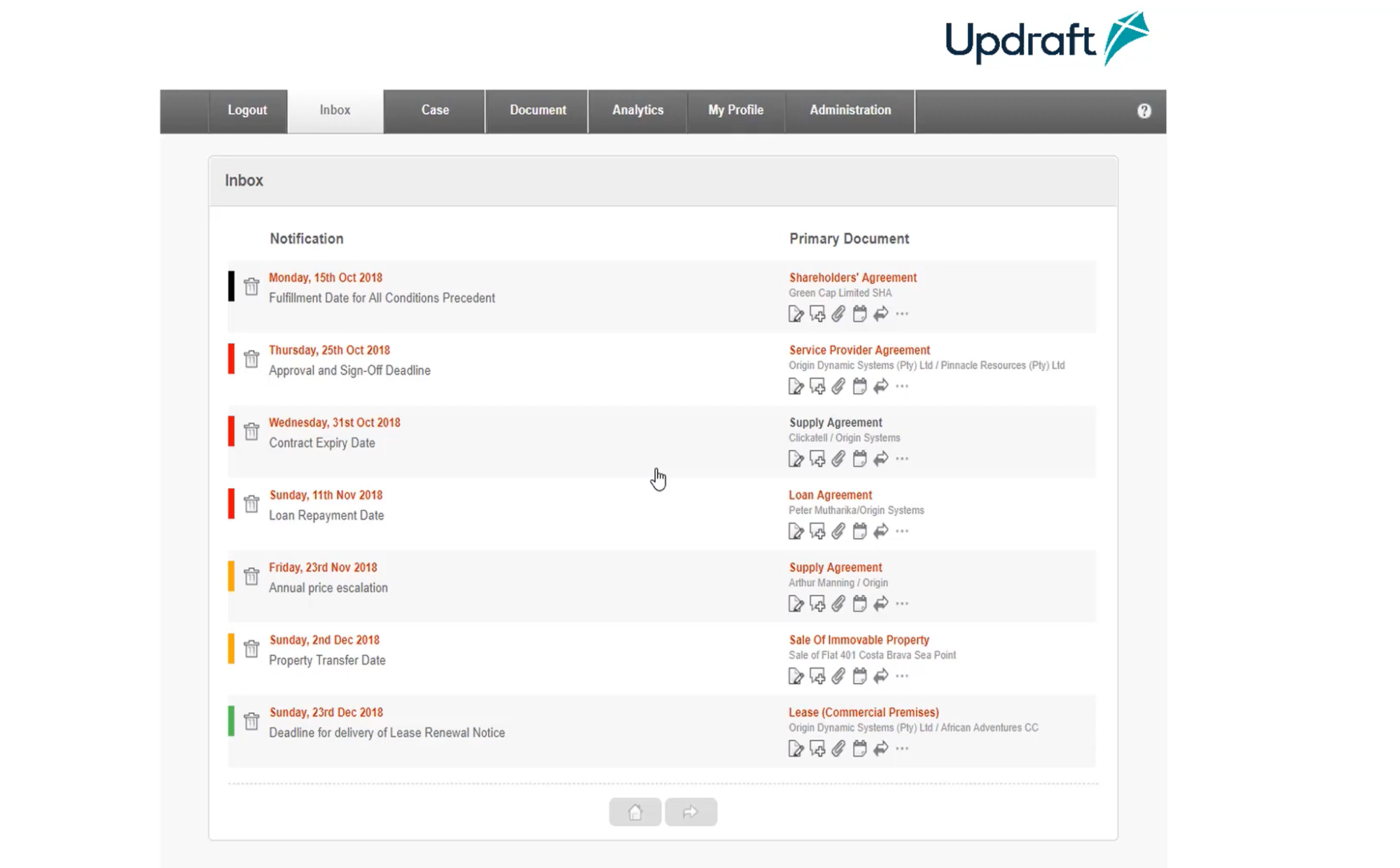

3. Updraft

Updraft is a contract management platform that significantly reduces drafting time, offering a solution that streamlines legal control and compliance. It’s praised for its user-friendly interface and support, marking it a choice partner for numerous companies globally, including Deloitte.

Key Features

- Questionnaire-based contract authoring: Simplify the process of creating insurance contracts by using intuitive questionnaires tailored to gather essential information, ensuring accuracy and completeness in document creation.

- Approval workflows: Facilitate efficient approval processes by implementing customizable workflows, allowing stakeholders to review and authorize insurance contracts promptly, reducing bottlenecks, and ensuring compliance.

- Seamless signing: Expedite the signing process by providing a seamless electronic signature experience, enabling stakeholders to sign insurance contracts securely and conveniently from any device or location.

- AI technology for document generation: Enhance productivity and accuracy in generating insurance contracts with AI-powered document generation capabilities, automating repetitive tasks and ensuring consistency while adapting to evolving needs.

Pricing

You’ll need to contact Updraft directly for a quote.

Pros & Cons

Pros

- Designed for enterprise CLM needs

- Flexible deployment options

- Intuitive user interface

Cons

- No pricing information available

- Outdated UI

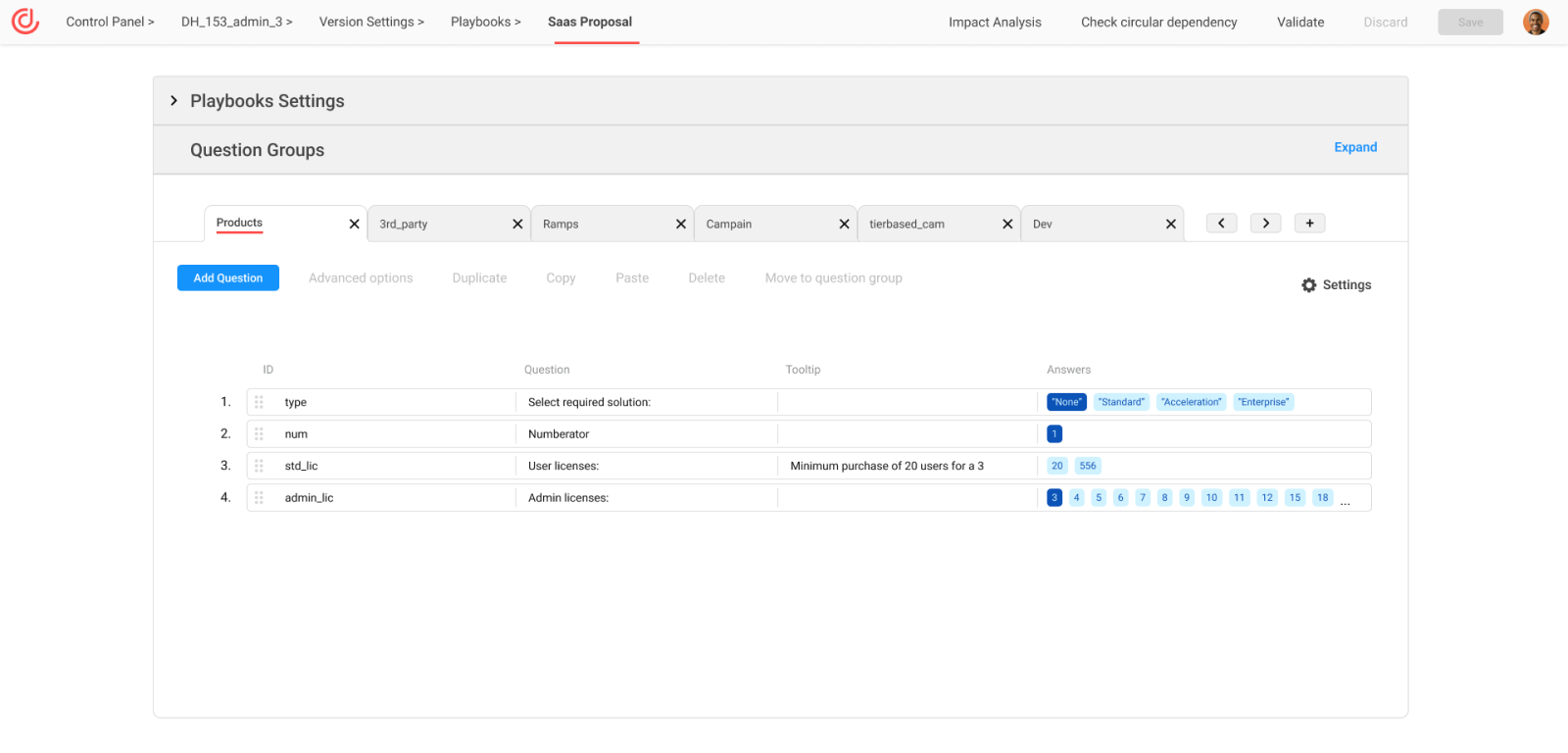

4. DealHub

DealHub is a CLM platform with integrated cost, price, quote (CPQ), and revenue tools for insurance businesses. With DealHub, users can easily create, track, and manage all aspects of their insurance contracts from one centralized location.

Key Features

- CRM integration: Automatically fill contract templates with data pulled from integrated CRMs to speed up the creation process and minimize errors.

- Simplified collaboration: Invite customers and partners to collaborate on contracts in real-time, streamlining the negotiation process.

- Advanced notifications: Get notifications when customers view or sign contracts, make edits, request changes, or approve quotes.

- Reporting and analytics: Gain insights into contract performance, identify other stakeholders that have accessed contracts, and enhance the buyer journey with quicker response times.

Pricing

You’ll need to contact the sales team for a custom quote.

Pros & Cons

Pros

- Great integrations

- Streamlined approval process

- Clear visibility on terms and discounts

- Excellent customer support

- Highly customizable

Cons

- Implementation difficulties

- Recurring technical issues

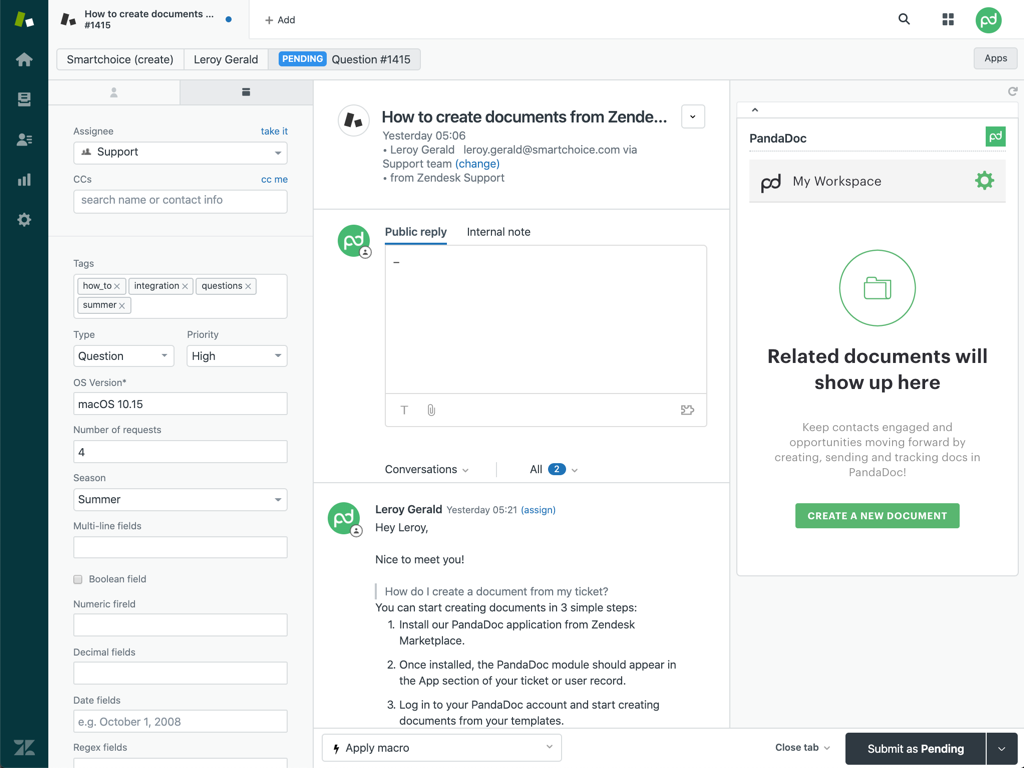

5. PandaDoc

PandaDoc is a versatile document management platform, specifically designed to streamline and enhance the efficiency of contract management processes within the insurance sector and beyond.

It’s an all-in-one solution that lets users create, edit, send, track, and e-sign documents, providing a seamless experience from proposal to contract completion. But it isn’t a perfect tool—check out our guide to PandaDoc alternatives to learn more.

Key Features

- Comprehensive CRM integration: Offers seamless integration with a variety of CRM systems, ensuring that contract management processes are perfectly aligned with sales and customer data for more streamlined operations.

- Automated workflows and e-signatures: Allows for automated workflow creation, including using electronic signatures to expedite the contract signing process, making it faster and more efficient.

- Customizable templates: Users have access to a wide range of customizable templates, which can be tailored to meet specific requirements, ensuring that documents not only look professional but are also coherent with brand standards.

- Real-time tracking and analytics: Provides detailed insights into document engagement, allowing users to track how documents are interacted with by recipients. This feature is invaluable for understanding client behaviors and optimizing future interactions

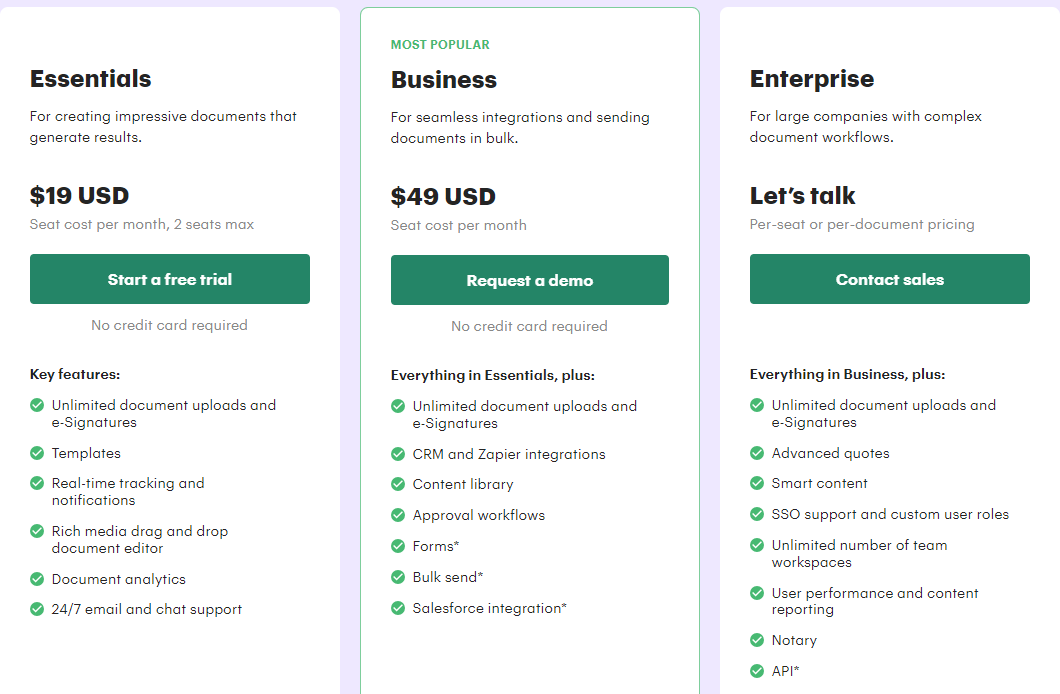

Pricing

PandaDoc offers three plans:

- Essentials ($19/mo/user, 2 users max)

- Business ($49/mo/user)

- Enterprise (custom)

Pros & Cons

Pros

- User-friendly interface

- Comprehensive CRM integrations

- Effective document tracking

- High-quality customer support

Cons

- Potential hidden fees

- Limitations in design customization

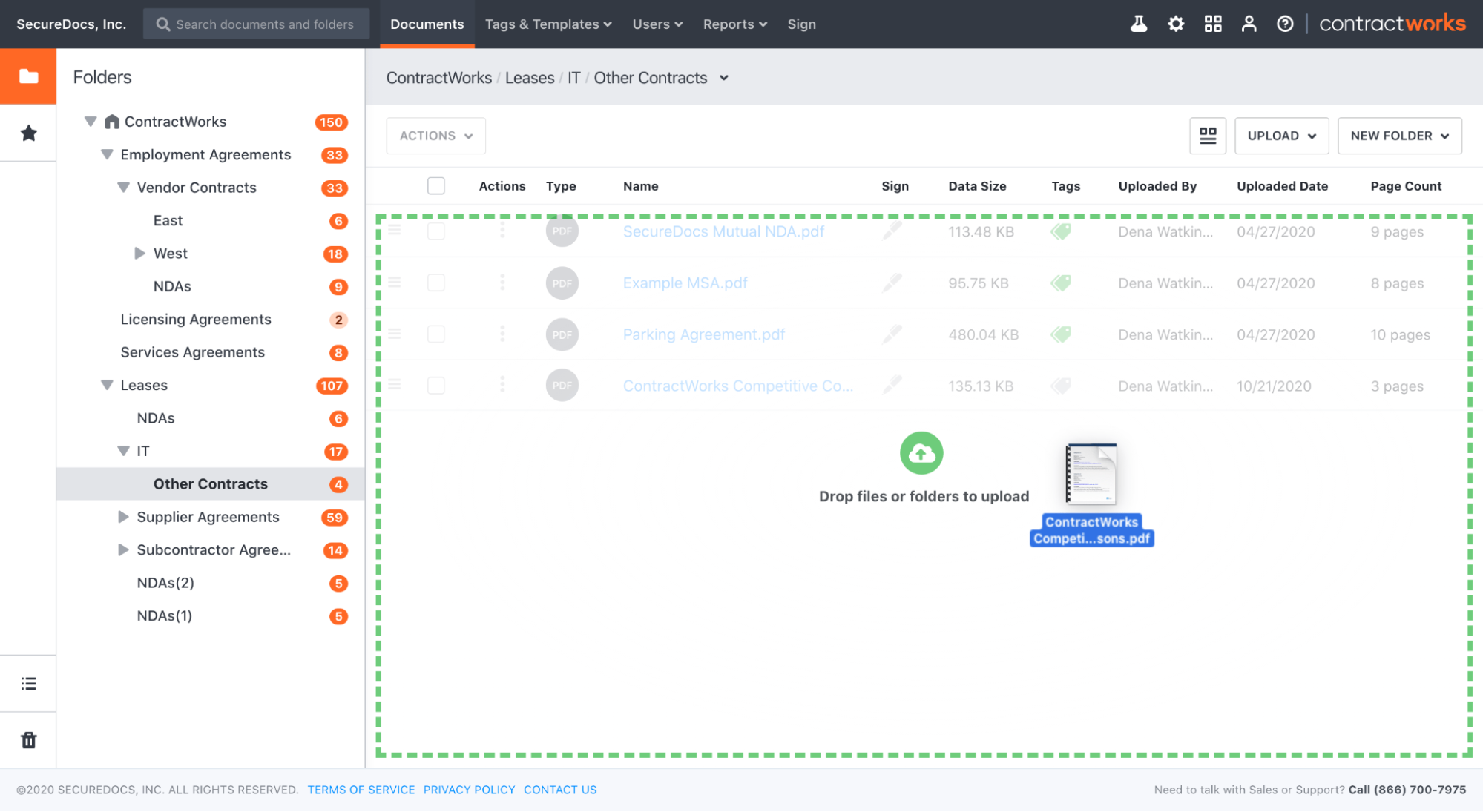

6. ContractWorks

ContractWorks is user-friendly and efficient contract management software that improves document routing and tracking. It offers e-signing features, a contract repository, automated approvals, and AI clause generation to reduce human error.

It also integrates with popular CRMs to streamline contract management processes.

Key Features

- Electronic signature: Simplify the signing process and accelerate contract execution with electronic signature capabilities, ensuring secure and legally binding agreements.

- Contract repository: Store all contracts in a centralized and secure location for easy access and organization. Easily retrieve what you need with advanced search and filter options.

- Automated approval flows: Develop tailored workflows to effectively automate the contract approval process, streamlining operations, enhancing efficiency, and saving valuable time.

- AI clause generation: Enhance your drafting efficiency by leveraging AI-powered clause suggestions to minimize errors and accelerate the process. Tailor your own clauses to streamline contract creation and ensure precision in your documents.

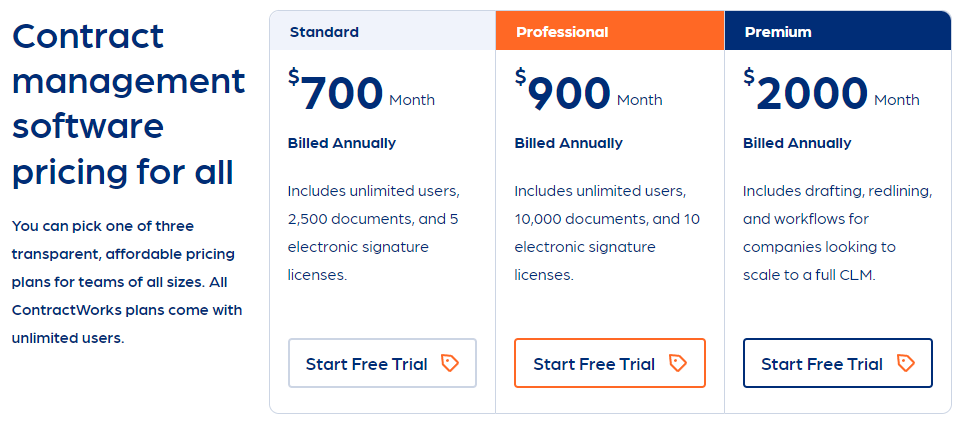

Pricing

ContractWorks offers three plans:

- Standard ($700/mo)

- Professional ($900/mo)

- Premium ($2000/mo)

Pros & Cons

Pros

- User-friendly

- Efficient document routing

- Customizable reports

- Excellent customer support

- Value for money

Cons

- Issues with search

- No private notes for individual approvers

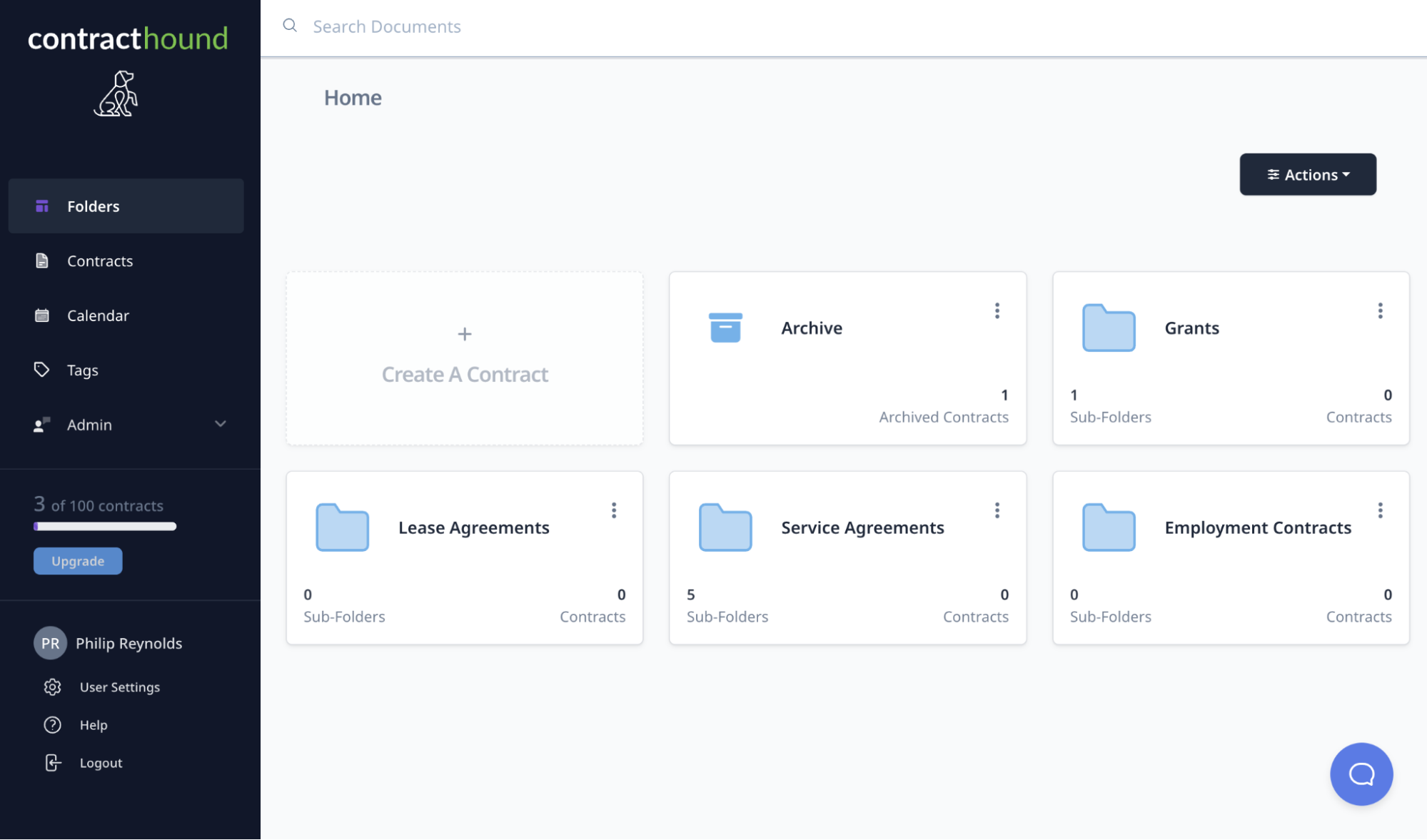

7. Contract Hound

Contract Hound is a cloud-based contract management solution designed for small- to mid-sized businesses and non-profits. It’s designed to assist organizations in never missing crucial renewal dates, keeping contracts organized, and ensuring data is efficiently managed within the system.

Key Features

- Cloud-based solution: Offers a user-friendly, web-based solution for securely storing, organizing, and setting up alerts for customer and vendor contracts, ensuring seamless contract management.

- Centralized storage: Supports centralized storage of contracts, amendments, and supporting documents with easy upload functionality, enhancing organization and accessibility.

- Reminders: Lets users set reminders for contract renewal dates, milestones, and other important events to ensure timely action is taken.

- Real-time collaboration: Offers an activity stream for each contract that enables team collaboration in real-time, viewing key document changes and adding notes.

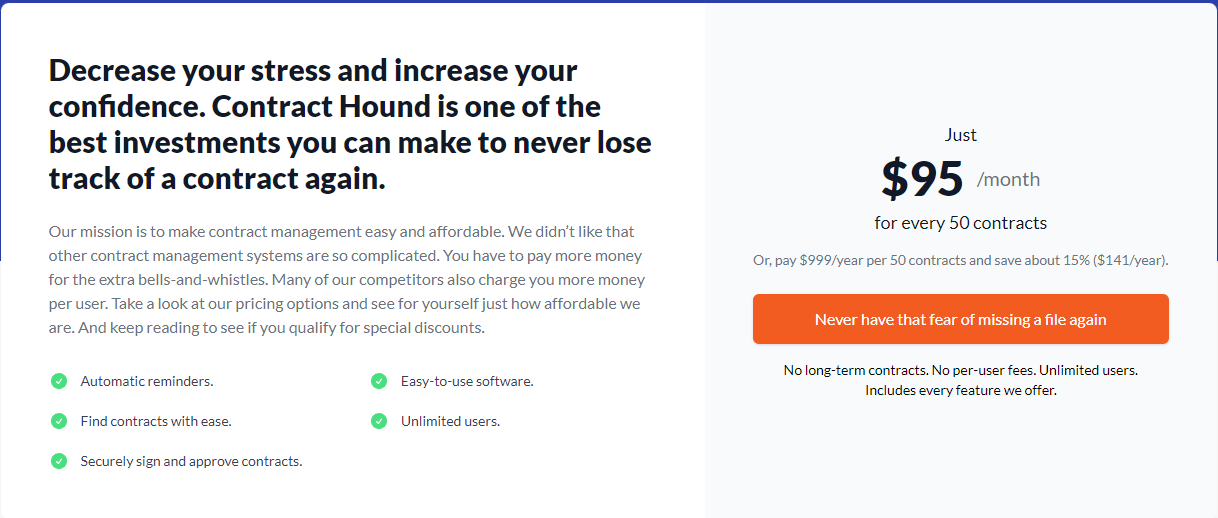

Pricing

Contract Hound costs $95/month for every 50 contracts. They allow for unlimited users, with no per-user fees.

Pros & Cons

Pros

- Commendable customer service with quick response times

- Centralized storage of contracts and amendments

- Cost-effective, transparent pricing

- Consistently updates to meet user needs

- Ease of use

Cons

- Lacks an API for integration with other systems

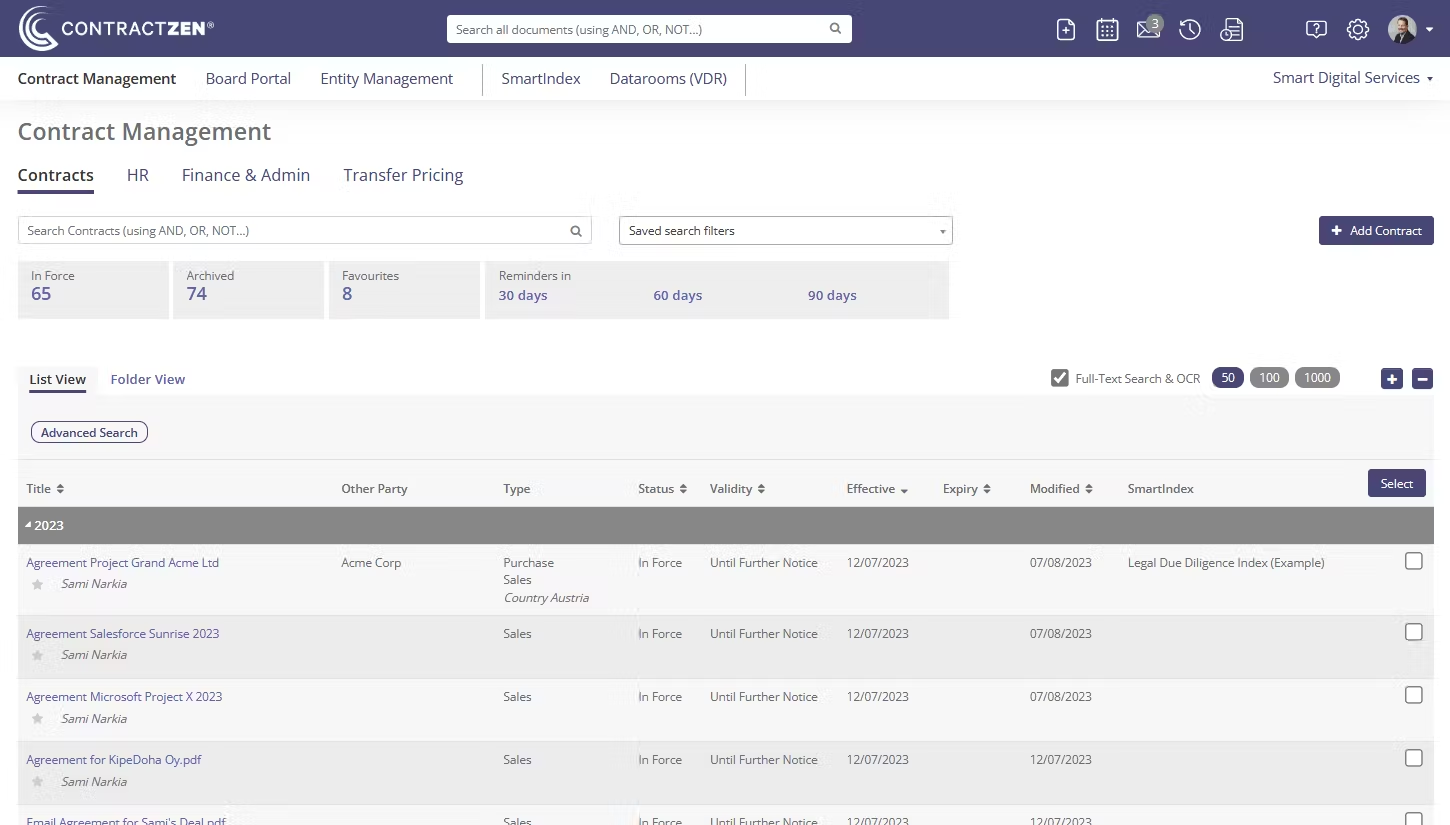

8. ContractZen

ContractZen is a cloud-based governance software offering electronic signature and contract management among other features. It is designed for a broad range of industries, including insurance, making it a versatile choice for managing contracts, board meetings, entity management, e-signatures, and virtual data rooms (VDR).

This comprehensive solution emphasizes ease of use and security, making contract management efficient and straightforward.

Key Features

- E-signature integration: Integrates with various e-signature tools to streamline the signing process and ensure legally binding contracts.

- Virtual data rooms (VDR): Offers secure virtual spaces for sharing and storing sensitive contract-related documents, enhancing data security and accessibility.

- Document collection and organization: Enables easy storage and retrieval of important documents with features like custom tags, folders, and search functions.

- Automated reminders: Get automated notifications and reminders for upcoming contract renewals, deadlines, and important milestones.

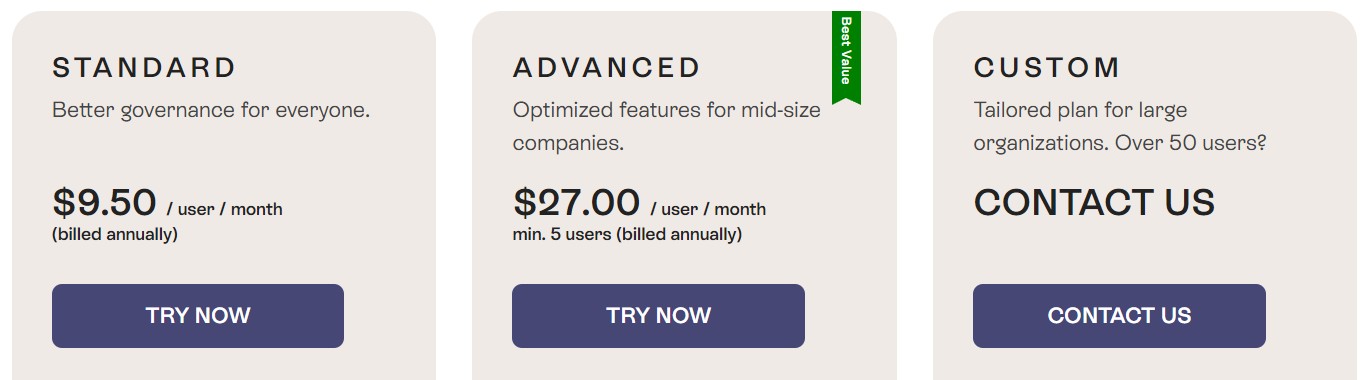

Pricing

ContractZen has three plans—Standard ($9.50/user/month), Advanced ($27/user/month), and Custom.

Pros & Cons

Pros

- Very easy to use

- Comprehensive features

- Exceptional customer support with quick responses

- Great document storage options

- Intuitive and user-friendly interface

- Competitive pricing

Cons

- No built-in e-signature

- Design and interface could be improved

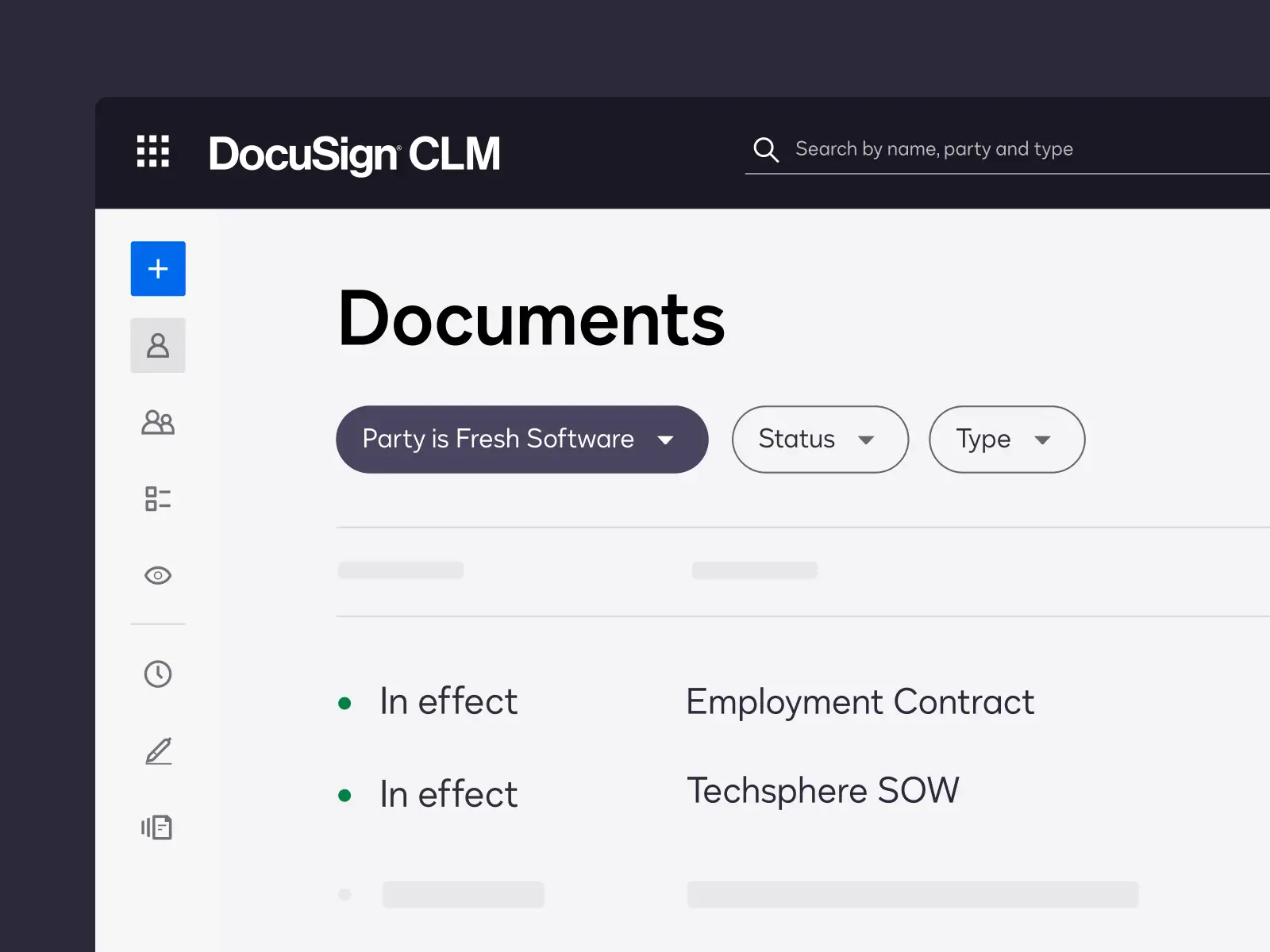

9. Docusign

Docusign is a highly-regarded electronic signature and digital transaction management software that streamlines the document signing process, increases compliance, and enhances the efficiency of contract management. It’s well-suited for insurance companies looking to digitize and automate their contract lifecycle, from creation through signing and management.

Key Features

- Document Management: Streamlines the process of sending, signing, and tracking documents to enhance efficiency and productivity across various workflows.

- Security and Compliance: Offers encryption, authentication, and compliance with a wide range of regulations and standards.

- Integrations: Compatible with major software systems like Salesforce, Microsoft Office 365, and Google Drive.

- Mobile Accessibility: Enables contract management on the go, although the mobile experience may vary.

Pricing

Contact their sales team for more information about pricing.

Pros & Cons

Pros

- Universally compatible across email providers and operating systems

- User-friendly interface with a simple layout

- Cloud-based, ensuring documents don’t consume device storage

- Streamlines the contract signing process

- Offers a high level of document security and compliance

Cons

- Some users want more robust document editing and annotation tools

- No pricing information available

10. LinkSquares

LinkSquares offers a comprehensive solution for managing insurance contracts, focusing on streamlining and automating contract management processes through the use of artificial intelligence and integrations with other systems like Salesforce, Google Drive, and DocuSign.

Key Features

- Text search: Allows users to search for specific terms or clauses within contracts (even scanned images and PDFs) to simplify retrieval.

- Automated workflows: Simplifies contract review and approval processes by automating tasks and notifications based on preset rules.

- Contract collaboration: Enables users to collaborate on contracts in real-time, including the ability to track changes, add comments, and assign tasks.

- User access customizations: Offers flexible user access controls, allowing administrators to set permissions for each user or group based on their role and responsibilities.

Pricing

No pricing information is available—you’ll need to contact their sales team directly.

Pros & Cons

Pros

- Integrates with other systems

- Advanced text search and OCR capabilities

- Simplifies retrieval and management of key documents

- Provides insights into contracts

- Automates contract analysis

Cons

- Tagging can be quite tedious

- Occasional performance issues

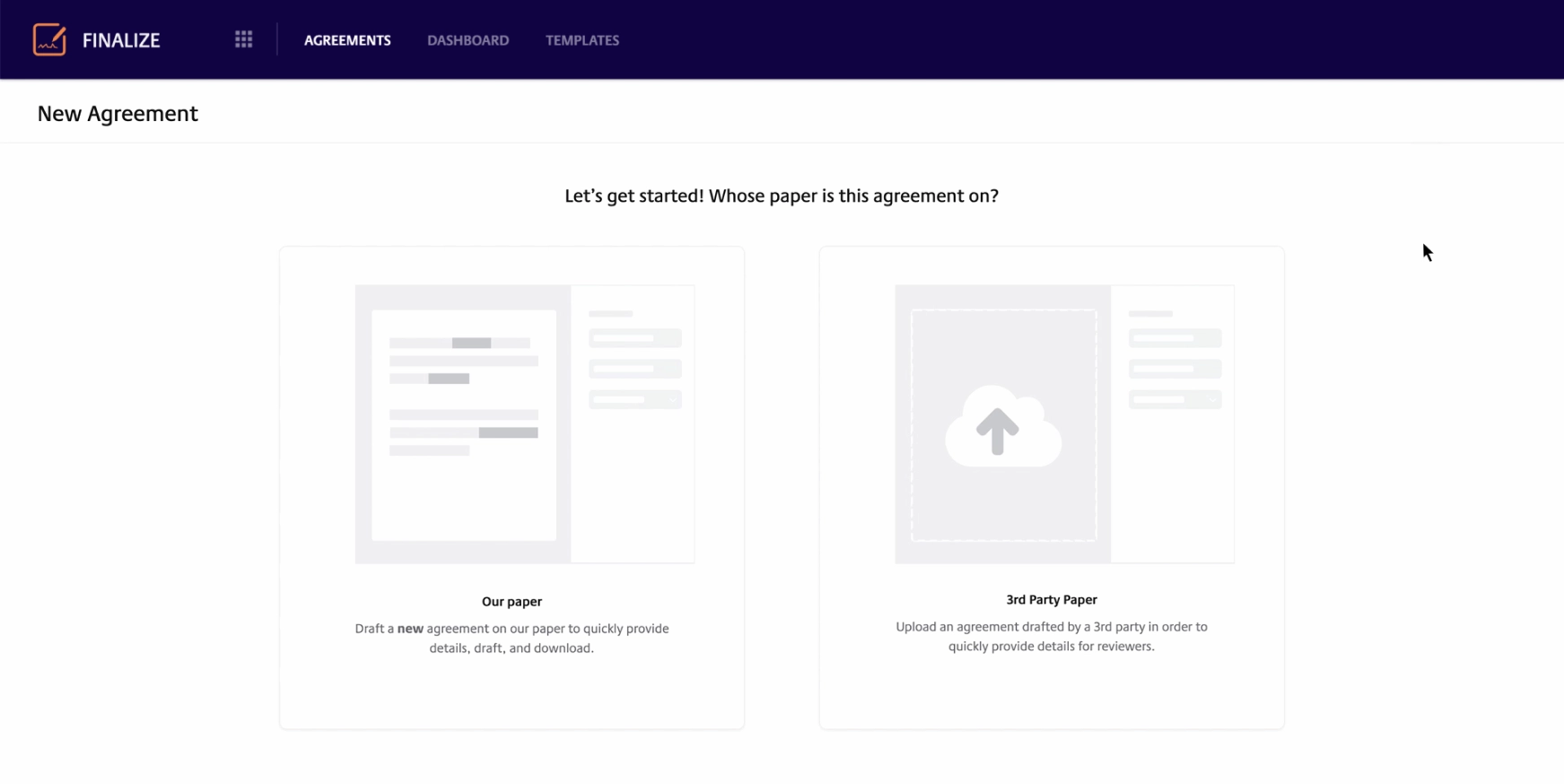

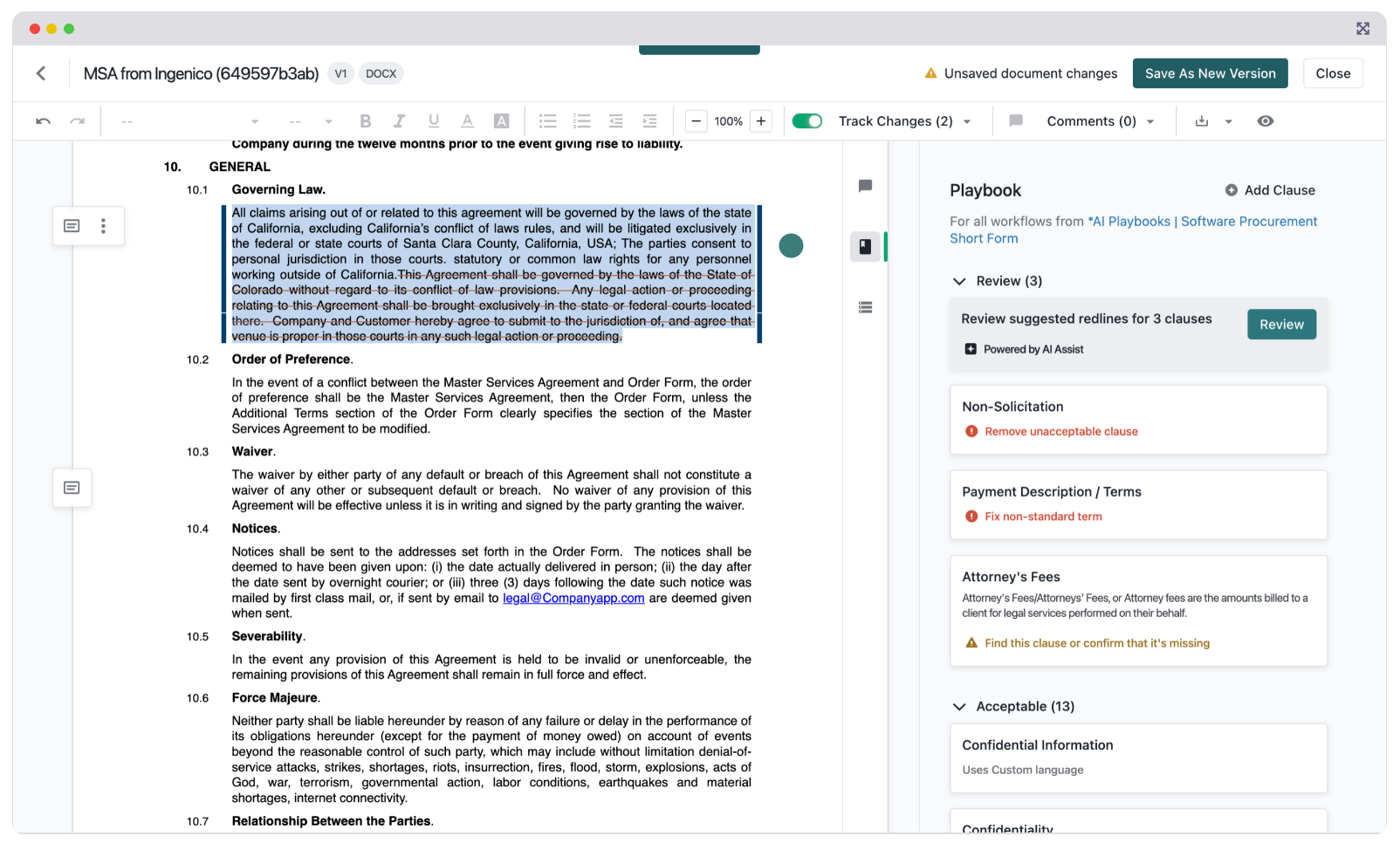

11. Ironclad

Ironclad is a modern CLM that offers a user-friendly interface and advanced features for managing contracts. It allows users to create, negotiate, and collaborate on contracts in real time, making the contract process more efficient and transparent.

For professionals in the insurance industry, it offers powerful tools for working with legal departments to ensure compliance and mitigate risks.

Key Features

- Workflow customization: Allows for conditional approvals and assigning signers to route documents correctly.

- Security and confidentiality: Offers role-based access and audit trails for sensitive contract information.

- Clause library and templates: Facilitates quicker contract drafting with pre-approved clauses and templates.

- Ironclad AI: Get AI to amend clauses, write new ones from scratch, explain inconsistencies and errors, and more.

Pricing

Ironclad’s pricing isn’t directly listed on its website. Instead, it offers customized pricing plans based on your business’s specific needs, which can include a mix of its contract management, repository, or clickwrap solutions.

Pros & Cons

Pros

- Easy integration with other platforms

- Intuitive and simple to use

- Conditional approval workflows

- High security

- Clause libraries and pre-approved templates are available

- Enhances collaboration with tools for comments and version tracking

Cons

- Setting up automated documents can be challenging

- The interface is sometimes slow to load

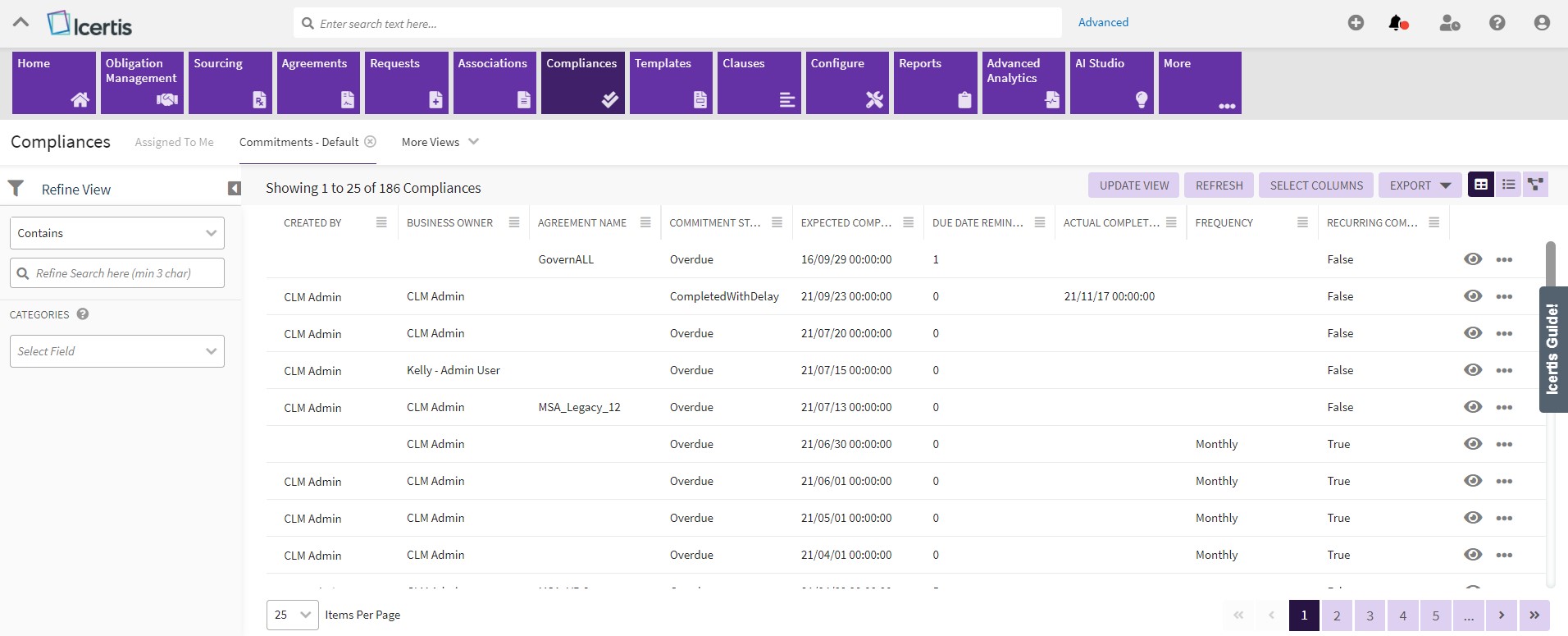

12. Icertis Contract Intelligence

Icertis offers a comprehensive and AI-driven contract management solution that significantly enhances the efficiency and effectiveness of contract management processes. It is designed to help organizations of all sizes manage the entire contract lifecycle—from creation to execution, including vendor agreements, NDAs, and more.

Key Features

- Contract creation and management: Streamlines the process with pre-approved templates and built-in e-signature capabilities.

- Contract compliance: automatic tracking and cataloging of obligations within clauses and terms to ensure regulatory compliance.

- Analytics and reporting: Offers deep insights into contract performance and portfolio management.

- Ease of integration: Designed to integrate with leading applications, enhancing enterprise-wide contract data leverage.

Pricing

No pricing information is available on their website. You’ll need to contact them directly for a quote.

Pros & Cons

Pros

- Efficient document storage

- Customizable and flexible

- Streamlined contract management

- Advanced analytics

- Compliance and renewal management

- Integration capabilities

Cons

- Users have reported difficulties managing larger agreements

- Some users find the notification system overwhelming

- Mobile responsiveness needs improvement

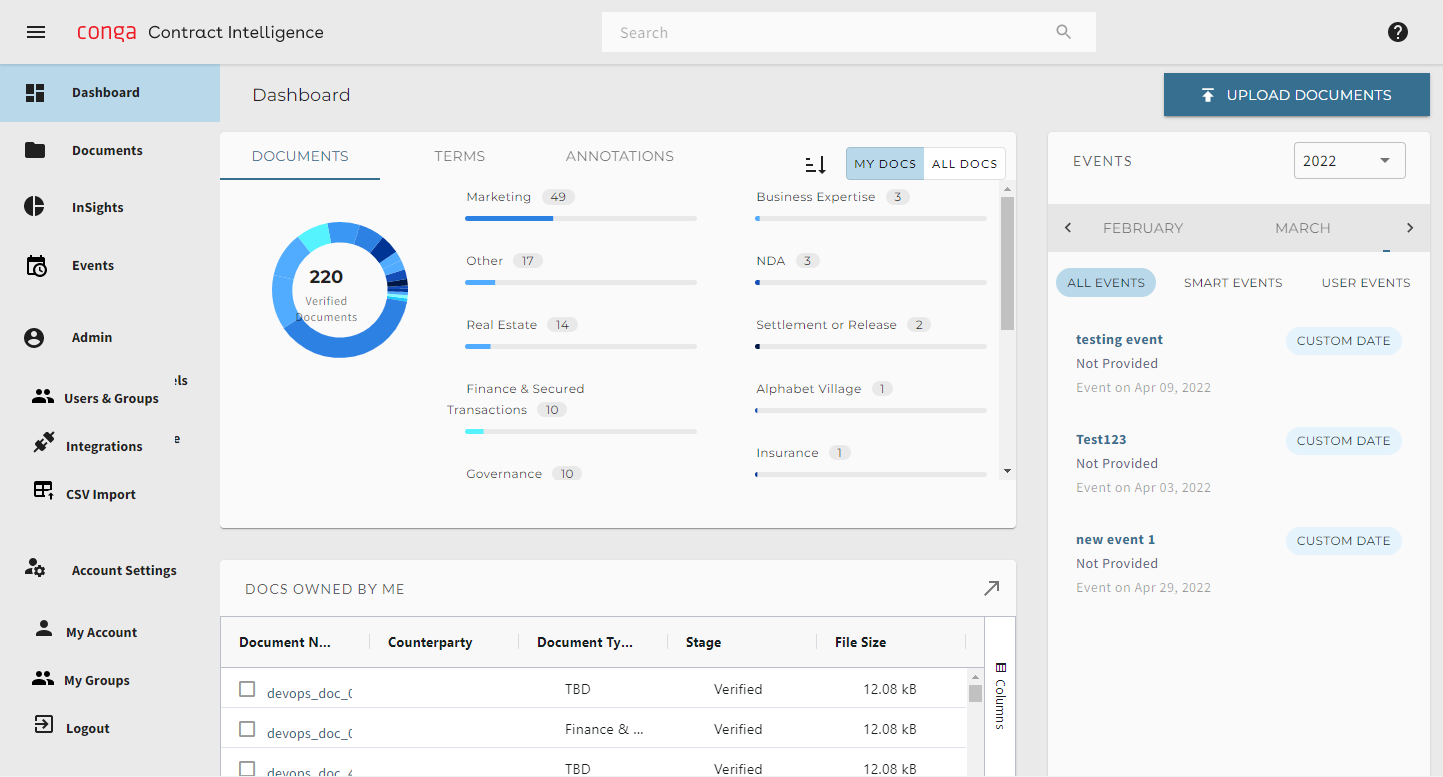

13. Conga Contracts

Conga Contracts is a CLM that enhances the efficiency of contract management processes, from initiation to execution and storage. Key features include seamless integration capabilities, particularly with Salesforce, and highly configurable settings for personalized contract management.

Users appreciate its robust, user-friendly administration interface and the system’s capacity for automating and tracking processes in detail.

Key Features

- Contract automation: Streamlines the entire contract lifecycle, enhancing efficiency from creation to execution.

- Integration capabilities: Seamlessly connects with Salesforce and other commonly used platforms for a unified contract management experience, integrating contract processes with existing workflows.

- Contract intelligence: Provides insights to manage risks and optimize revenue, leveraging AI to uncover valuable contract data.

- Customizable templates: Offers the ability to tailor contract templates to specific needs, although it requires knowledge of HTML for customization.

Pricing

You’ll need to contact sales for specific pricing details, as prices vary based on company size and needs.

Pros & Cons

Pros

- Quick and easy setup

- Highly configurable

- Efficient document management

- Excellent integration with Salesforce

- Customizable templates

Cons

- Integration limitations

- Template customization difficulty

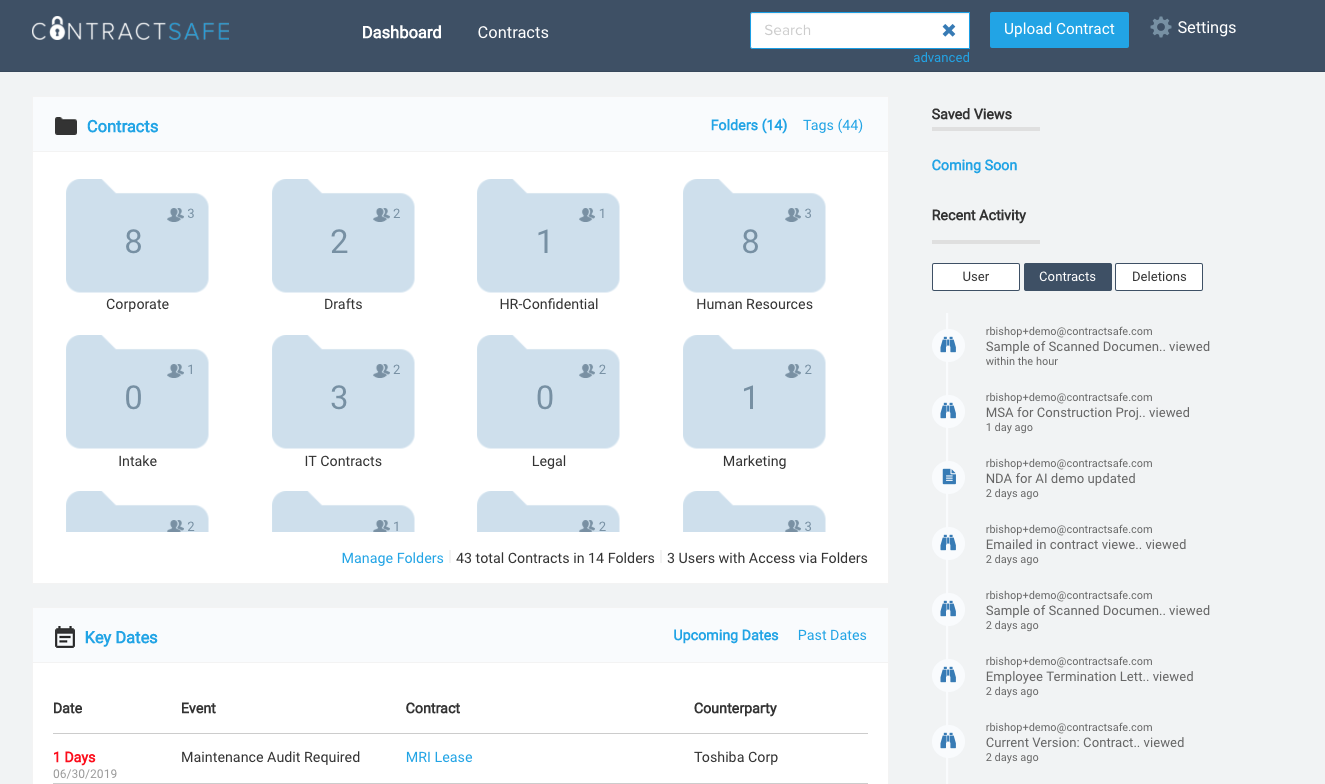

14. ContractSafe

ContractSafe is a user-friendly contract management solution that is appreciated for its ease of implementation, customizable features, and exceptional customer support. It significantly streamlines the processes involved in managing contracts, offering a centralized location for all agreements which is critical for effective business operations.

The platform addresses core needs and goes beyond by enhancing operational processes and procedures.

Key Features

- Centralized document storage: Simplify document management by storing all contracts in one secure location.

- Customizable templates: Create and store custom templates for frequently used contract types, saving time and increasing accuracy.

- Two-way Docusign integration: Seamlessly send and receive contracts for e-signature, eliminating the need for manual printing and scanning.

- Automated reminders: Get notified when contracts are approaching expiration, providing ample time for renegotiation or renewal.

Pricing

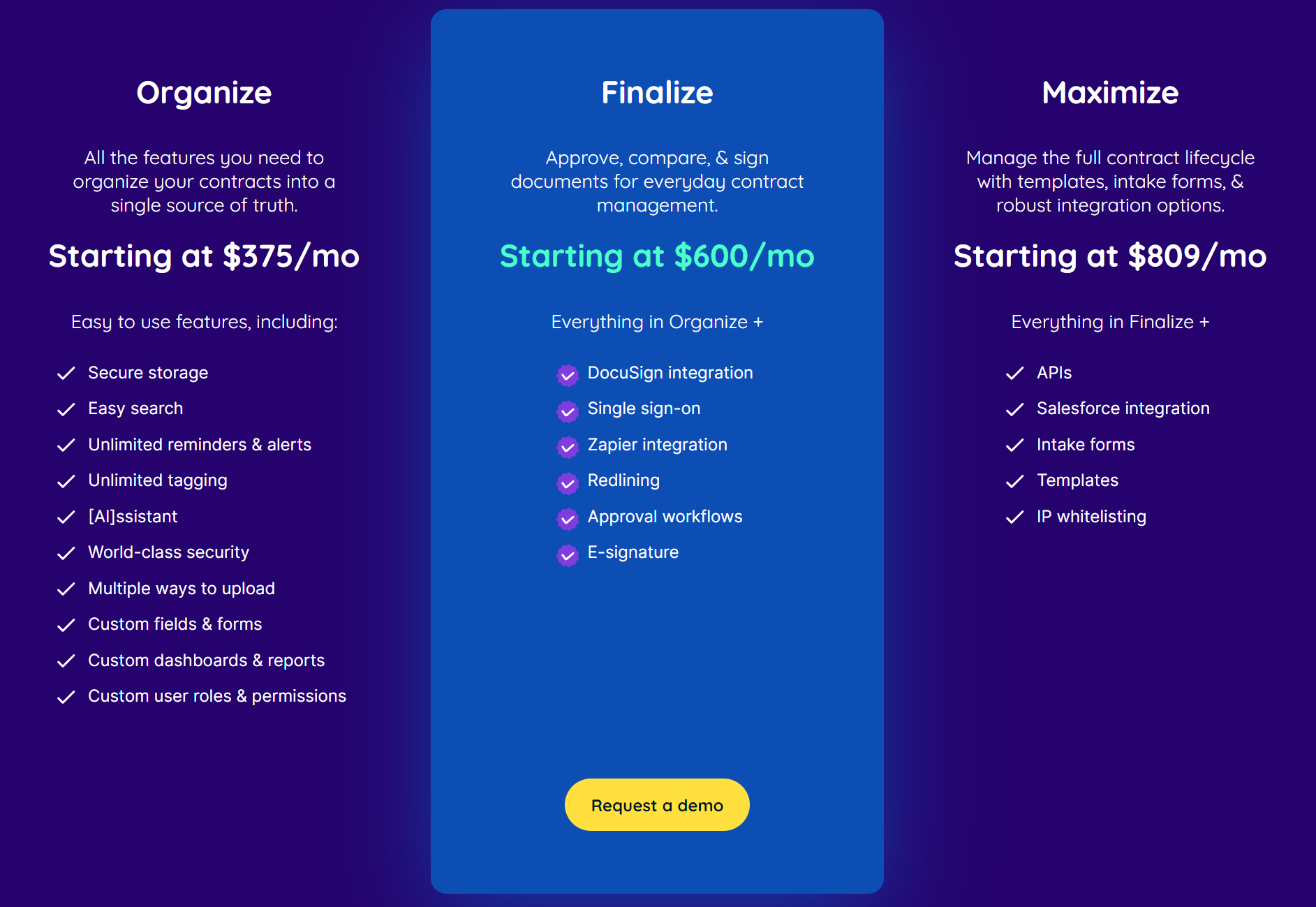

ContractSafe’s pricing starts at $375/month for Organize, $600/month for Finalize, and $809/month for Maximize. Plans offer features including secure storage, e-signatures, approval workflows, and integrations.

Pros & Cons

Pros

- User-friendly and easy to implement

- Customizable to fit business needs

- Efficient document loading and access

- Responsive and helpful customer support

Cons

- Requires manual work

- AI features could be faster

- Some users desire enhanced document lock features for added security

Conclusion

There you have it—fourteen contract management tools that will work well for all kinds of insurance industry professionals and businesses. Whether you’re looking for a solution that’s more focused on e-signing, or an end-to-end contract management platform, there’s something for everyone on this list.

At SignWell, we’re committed to making e-signatures and contract management as simple, affordable, and secure as possible for our customers. With a best-in-class e-signature workflow and powerful features under the hood, we’re confident that our product can streamline your contract management processes and help you close deals faster.

Sign with a team that knows what you need.

Putting a signature on a document shouldn’t be hard. The SignWell mission? Simplify how documents get signed for millions of people and businesses.

Get Started Todaybusinesses served, so far...

total documents signed

customer support satisfaction