Quick Summary

QuickBooks Online is a popular accounting tool, but it lacks full e-signature functionality for remote workflows. This guide highlights how SignWell integrates natively with QuickBooks, allowing you to send estimates, invoices, and contracts for signature directly within the platform. With SignWell, you can facilitate document approvals, improve efficiency, and eliminate signature bottlenecks. For more in-depth and practical e-signature tips, visit our blog.

Looking for an Honest QuickBooks Online Review?

QuickBooks Online has dominated the small business accounting space for years, becoming the go-to solution for millions of entrepreneurs. The platform handles everything from basic bookkeeping to complex financial reporting with relative ease.

However, the landscape is changing rapidly. Price increases with missing modern features, like native eSignatures, are forcing businesses to reconsider their options. The question isn’t whether QuickBooks works; it is whether it’s still the best choice for your business.

In this guide, we’ll examine QuickBooks Online, its strengths, limitations, and also introduce the only native e-signature provider to integrate with QuickBooks Online: SignWell.

Why Listen to Us

At SignWell, we’ve helped over 65,000 businesses streamline their document signing processes. With millions of documents processed through our platform, we understand what businesses truly need from e-signature software. We’ve extensively tested QuickBooks Online’s limited signature capabilities and recently launched a native integration with QuickBooks Online, giving us deep insight into where QuickBooks falls short and how businesses can bridge those gaps effectively.

What is QuickBooks Online?

QuickBooks Online is a cloud-based accounting tool for small to medium-sized businesses. Unlike the desktop software, it works directly in your web browser, so you can access it from anywhere.

It offers more than just bookkeeping, with features like invoicing, expense tracking, tax tools, and integrations with other platforms. With over 7 million businesses using it worldwide, QuickBooks is a leader in small business accounting.

What makes QuickBooks unique is its ecosystem, connecting accounting with banking, payments, payroll, and inventory. But one crucial step is missing: getting estimates and contracts signed before turning them into invoices.

Key Features of QuickBooks Online

- Core Accounting: QuickBooks Online automates income and expenses. It categorizes transactions and generates reports like profit and loss, balance sheets, and cash flow. It also connects to your bank accounts to pull in transaction data, reducing manual entry and ensuring accuracy.

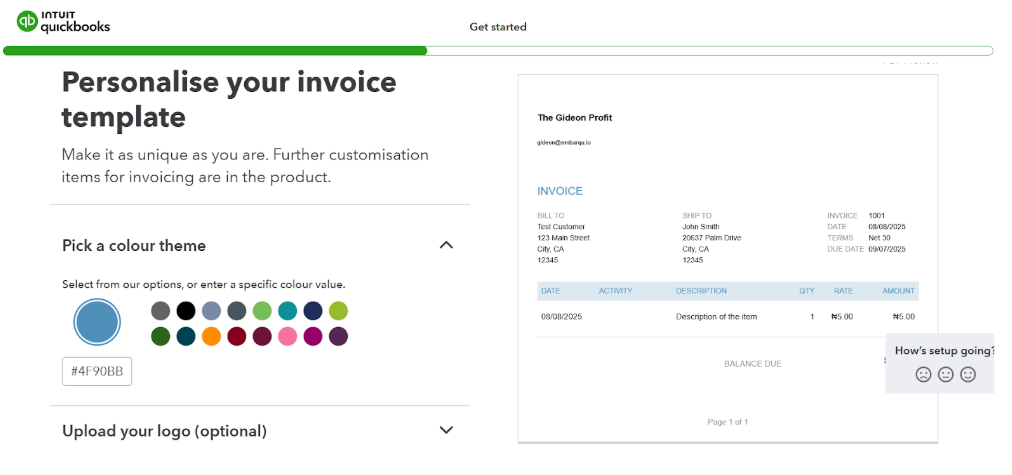

- Invoicing: This tool creates professional invoices, sends automatic payment reminders, accepts online payments, and tracks payment status in real-time. You can customize invoices with your logo, payment terms, and due dates for a professional, branded experience.

- Bank Reconciliation: It automatically imports bank and credit card transactions, matches them to entries, and highlights any discrepancies. QuickBooks can flag unmatched transactions, so you can quickly address discrepancies and ensure your books are accurate.

- Expense Management: You can snap receipt photos, track business expenses, categorize them by tax code, and separate personal transactions from business-related ones. You can also upload receipts directly through the mobile app, and QuickBooks will automatically match them to corresponding expenses.

- Tax Integration: QuickBooks Online syncs with TurboTax for easy filing, generates tax-ready reports, calculates estimated payments, and creates 1099 forms for contractors. It organizes all tax-related data throughout the year to make filing taxes and managing tax documents more straightforward.

- Multi-User Access: It lets your team and accountant work together with role-based permissions and track changes to ensure data accuracy. You can assign specific roles to each user, such as accountant or business owner, to control what they can access and edit.

Pricing

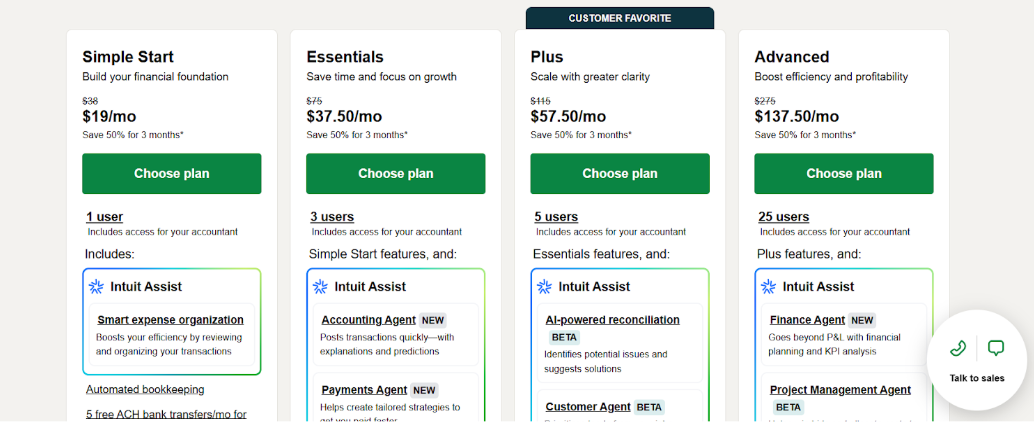

QuickBooks offers several plans tailored to businesses of different sizes and needs. Please note that prices vary by country. Here’s a breakdown of the monthly plans in the U.S:

- Simple Start ($38/month, $19/month for the first 3 months): Best for solo businesses, includes features like expense tracking, invoicing, and one user access.

- Essentials ($75/month, $37.50/month for the first 3 months): Adds the ability to track billable hours, manage payments, and up to 3 users.

- Plus ($115/month, $57.50/month for the first 3 months): Includes project tracking, inventory management, and 5 user access.

- Advanced ($275/month, $137.50/month for the first 3 months): Ideal for larger businesses, includes advanced reporting, 25 users, and enhanced customization.

Each plan includes a 30-day free trial to help you get started, and all plans offer access to Intuit Assist for automated task management.

What We Like

- Easy to Use: QuickBooks has a clean, intuitive interface that’s easy for beginners to navigate while offering enough advanced features for accountants and finance professionals to work efficiently.

- All-in-One Solution: It handles everything from income and expense tracking to payroll and reporting, reducing the need for multiple tools and streamlining financial management into one convenient platform.

- Great Mobile App: The mobile app lets you create invoices, scan receipts, and manage expenses on the go, making it easy to stay organized while away from your desk.

- Customizable Dashboards: QuickBooks allows you to customize dashboards to display your most important financial metrics, helping you track performance and make quicker, more informed business decisions.

- Reliable Bank Sync: Automatic bank syncing imports and categorizes transactions in real time, speeding up reconciliation, improving accuracy, and reducing the need for manual data entry.

- Widely Used by Accountants: Since most accountants already know QuickBooks, collaboration is easier, onboarding is faster, and communication about financial details is much smoother for businesses.

What We Don’t Like

- Rising Costs: Prices for QuickBooks Online have steadily increased, with some users paying significantly more than they did for desktop versions, making it harder for small businesses to budget.

- Weak Customer Service: Support is often inconsistent, with different agents providing conflicting advice. Long response times can be frustrating when urgent technical or billing help is needed.

- Limited Industry Features: QuickBooks is excellent for general accounting but lacks specialized tools for industries like construction or manufacturing, often requiring third-party add-ons to fill the gaps.

- No Native E-Signature: Without built-in e-signature support, estimates and contracts must be signed using external tools, causing delays in finalizing agreements and moving forward with invoices.

- Occasional Performance Issues: Some users experience slow loading times or glitches, especially during peak hours, which can interrupt workflows and delay important financial tasks.

A Better Alternative for eSignatures in QuickBooks: SignWell

Until now, QuickBooks Online users have been limited to basic mobile signature capture for in-person transactions. There has never been a native e-signature solution that integrates with QuickBooks to handle remote document signing workflows.

This gap has forced businesses to use separate platforms for document signing, creating disconnected workflows and manual data entry between systems. The result? Slower approval processes, increased administrative overhead, and missed opportunities for optimized customer experiences.

SignWell changes that. It’s the first and only e-signature platform built specifically for QuickBooks Online users. With SignWell, you can turn your existing QuickBooks estimates, invoices, and proposals into professional, legally binding documents that clients can sign electronically from anywhere, without leaving your accounting workflow.

Beyond closing the gap in QuickBooks, SignWell also streamlines broader business processes. It lets you send, sign, and manage documents electronically while maintaining full integration with your financial records. That means faster approvals, fewer AR delays, and better collaboration between you, your team, and your clients.

Kellie Parks from CPB says:

“SignWell solves the issue in QuickBooks Online of getting estimates signed, letting me know when they’re approved, and converting them to invoices. Aside from its many other uses—like getting reports signed off by clients and creating beautiful engagement agreements—it’s a seamless solution for our (and our clients’) AR hiccups.”

Key Features of SignWell

Comprehensive Electronic Signatures

- Legally Binding Signatures: Full compliance with ESIGN, UETA, and eIDAS regulations across multiple jurisdictions

- Multiple Signature Types: Hand-drawn, typed, or uploaded image signatures to accommodate user preferences

- Remote Signing Capabilities: Send documents via email for signing from anywhere, on any device

- Sequential & Parallel Signing: Define complex signing orders or allow multiple parties to sign simultaneously

Advanced Document Management

- Customizable Templates: Create and save professional document templates for consistent branding and faster processing

- Bulk Sending: Send documents to multiple recipients simultaneously for large-scale operations

- Universal Document Support: Sign any document type – PDFs, Word docs, contracts, agreements, proposals, and more

- Brand-Ready Templates: Apply your logo, colors, and style to every document so it always matches your business identity.

Workflow Automation & Tracking

- Smart Follow-Ups: Automatically nudge signers at set intervals to keep agreements moving without manual chasing.

- Live Status Alerts: Get instant updates the moment a document is opened, completed, or needs your attention.

- Full Activity Logs: A permanent record of every action taken on a document, complete with time, date, and location data for compliance.

- Centralized Tracker: See every document’s stage in the process from one easy-to-read dashboard.

Security & Compliance

- Advanced Encryption: Protects documents during transfer and storage with industry-leading security protocols.

- Multi-Step Verification: Adds an extra layer of protection by requiring more than just a password.

- Legal Compliance: Meets international e-signature regulations and industry standards

- Safe Archiving: Keeps all signed files securely stored with automatic backups for peace of mind.

Fast QuickBooks Integration

- Native QuickBooks Sync: Automatically sync signed documents back to corresponding QuickBooks records

- Automated Workflow: Convert QuickBooks estimates to signed contracts and back to invoices

- Customer Data Integration: Automatically populate signer information from your QuickBooks customer database

- Payment Processing: Combine document signing with payment collection for complete transaction workflows

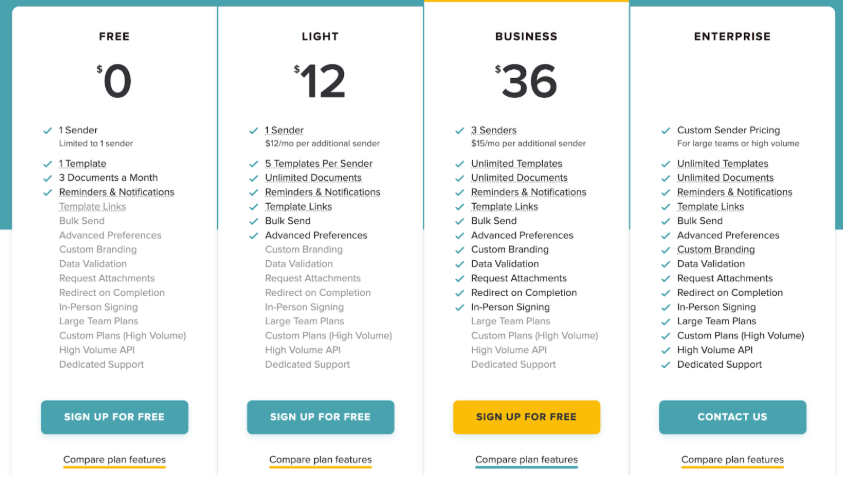

Pricing

- Free Plan: Ideal for testing SignWell’s core features, including up to 3 documents per month, 1 reusable template, and basic functionality.

- Light Plan – $12/month (billed monthly): Designed for individuals who need unlimited document sends and up to 5 reusable templates.

- Business Plan – $36/month (billed monthly): Built for teams, this plan includes 3 user seats, unlimited templates, and access to advanced features for streamlined collaboration.

- Enterprise Plan – Custom Pricing: Tailored for large organizations with high-volume needs, this plan offers dedicated support, API access, and scalable infrastructure.

How to Integrate QuickBooks Online With SignWell for Efficient Document Management

The good news about this integration with QuickBooks Online is that it is available on all SignWell plans, including the free tier.

Follow these simple steps to get started:

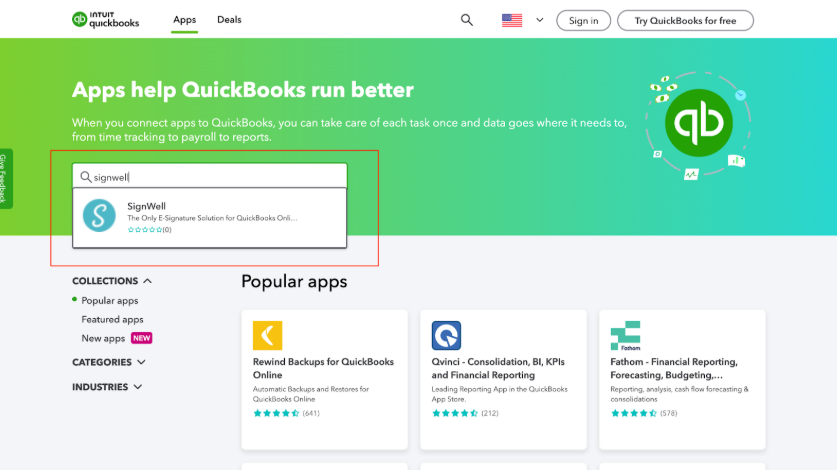

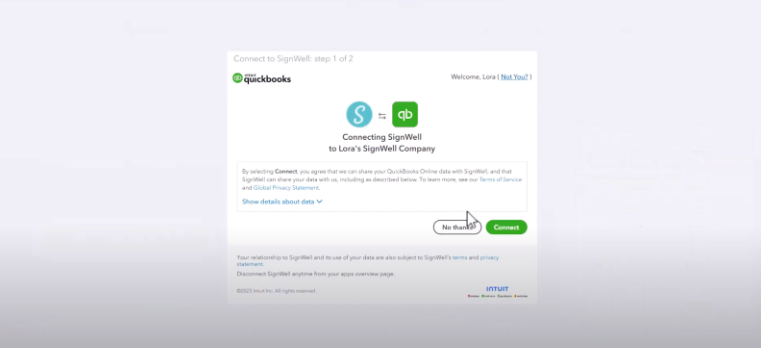

Step 1: Install the SignWell App

- First, sign up for a free SignWell account

- Then, go to the QuickBooks App Store and search for “SignWell”

- Click “Get App Now,” log in to your QuickBooks Online account, and authorize the connection to securely link both platforms.

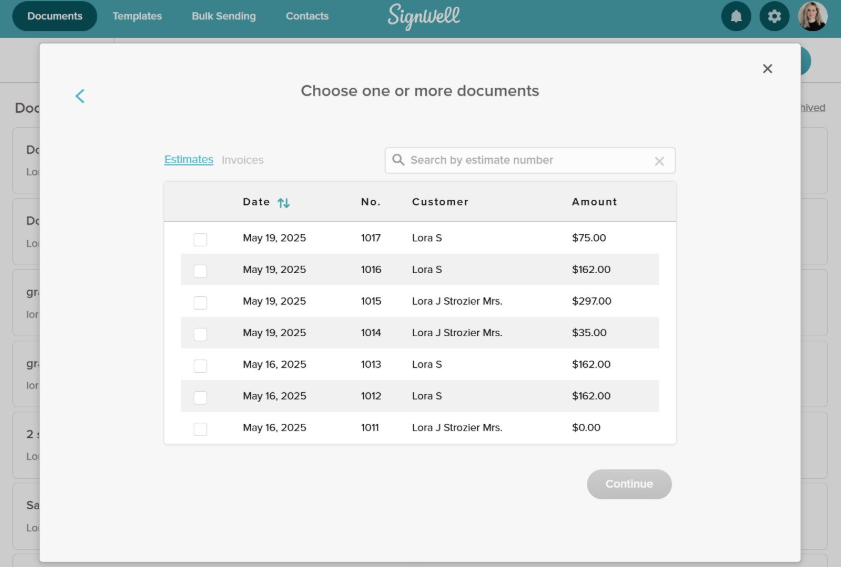

Step 2: Set Up Your Workflow

- Decide which document types, like estimates, you want to send for e-signature.

- SignWell automatically pulls client data from QuickBooks to pre-fill forms, eliminating manual entry.

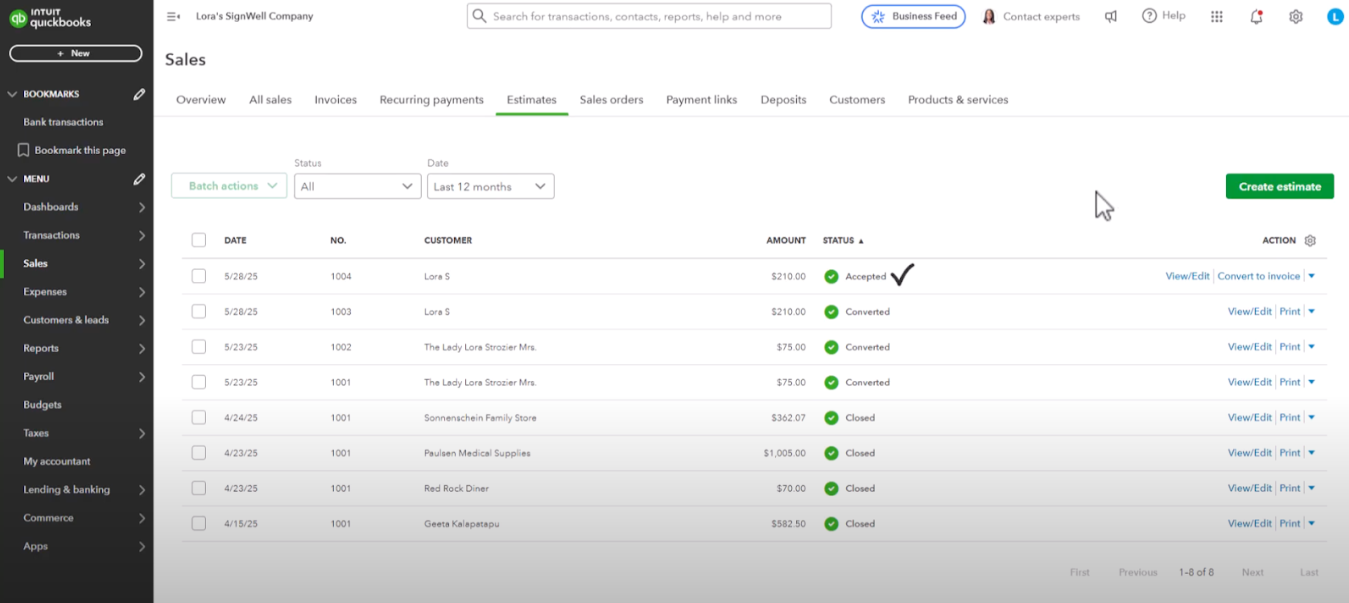

- Once signed, estimates can instantly convert into invoices inside QuickBooks, saving time and reducing errors.

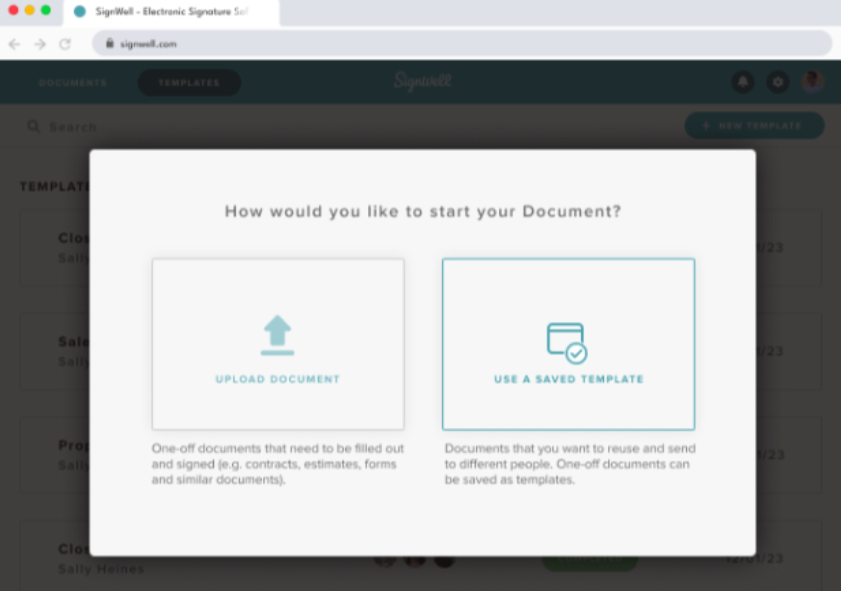

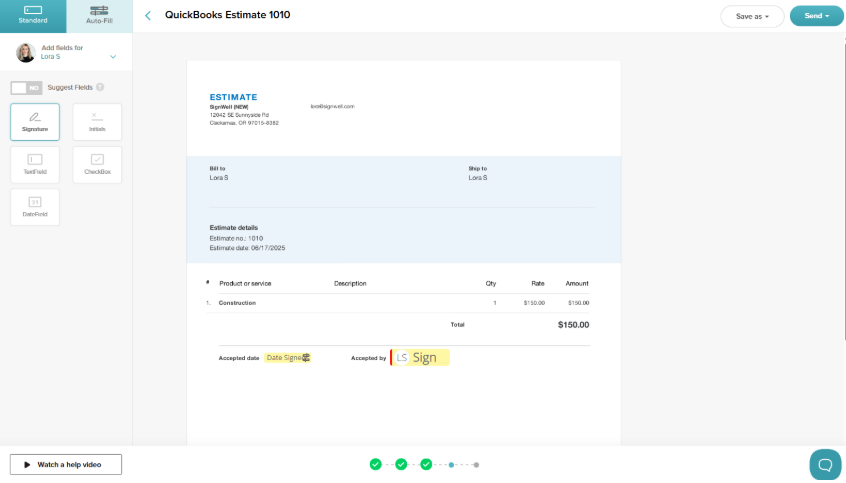

Step 3: Send a Document for Signature

- Open an existing estimate in QuickBooks

- Click “Send for E-Signature with SignWell”,

- Add recipients, place signature fields with a simple drag-and-drop, and click send.

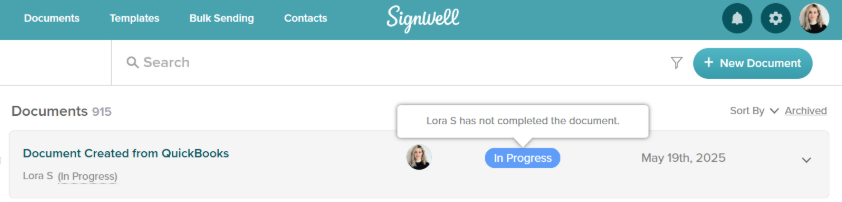

- Your signer receives a secure email link, and you can monitor their progress right from your QuickBooks dashboard.

Why Choose SignWell Native E-Signature with QuickBooks?

-

Full-fledged E-Signature Functionality

SignWell provides comprehensive e-signature functionality that supports remote document workflows. You can send contracts, proposals, and agreements via email for signing from anywhere, making it ideal for remote teams. The platform also enables you to create professional, branded documents, ensuring a consistent and polished image.

With its enterprise-grade security features, SignWell protects sensitive business documents while ensuring full legal compliance. This guarantees that your signed documents are valid and enforceable in legal proceedings, providing peace of mind.

SignWell also supports multiple signers and lets you manage the signing order. This feature streamlines workflows, reduces confusion, and saves time, ensuring documents are signed efficiently.

-

Superior User Experience

SignWell offers a hassle-free experience for both signers and document managers. With multi-device accessibility, recipients can sign documents from desktops, tablets, or mobile devices, making it easy to sign anytime, anywhere. Customizable branding ensures documents maintain a professional appearance, reflecting your business’s image.

It can prompt signers to complete their actions, speeding up the signing process. Real-time visibility into document status adds transparency, allowing both senders and recipients to track progress with ease.

Guided signing ensures that signers don’t miss any required fields, minimizing errors and delays. This feature enhances the signing process, making it both efficient and accurate.

-

Scalable Business Solution

As your business grows, SignWell scales with you, handling a wide range of document types beyond invoices and estimates. This flexibility makes it suitable for businesses of all sizes, from startups to large enterprises. Team collaboration features allow multiple team members to manage document workflows efficiently.

Advanced analytics provide valuable insights into signing patterns, completion rates, and opportunities for process optimization. These insights help you refine workflows and boost overall efficiency.

SignWell also offers custom integrations through its API, allowing you to build tailored workflows that fit your unique business needs.

-

Effortless Automation and Tracking

SignWell automates key aspects of your document workflows, saving time and boosting efficiency. Automated reminders prompt signers to complete documents on time, while real-time tracking provides full visibility, helping prevent delays and bottlenecks.

The QuickBooks integration automatically updates your records, reducing errors, while audit trails track all document activities, simplifying compliance and enhancing transparency.

By eliminating paper, printing, postage, and courier services, SignWell cuts costs and boosts ROI. Faster approvals also lead to improved cash flow, offering valuable financial benefits for your business.

-

Collaborative Features for Teams

SignWell makes team collaboration easy by allowing multiple users to manage document workflows. This ensures tasks are completed efficiently and without delay. Team members can track document statuses in real time, keeping everyone aligned.

The platform facilitates smooth coordination, making it simple to assign tasks and track progress. Whether your team is remote or in-office, everyone has access to the same updates, ensuring easy collaboration.

Using SignWell helps enhance document management, saving time and minimizing errors. Your team can stay informed and ensure documents move smoothly through each stage of the process.

-

Flexible Pricing Tiers for Every Business

SignWell provides flexible pricing plans to suit businesses of all sizes. Whether you’re a small startup or a large enterprise, you can choose the plan that fits your needs. This ensures you only pay for what you need, with no hidden fees.

As your business grows, SignWell’s pricing lets you scale easily. You can add more features or handle higher document volumes without worrying about unexpected costs.

With affordable pricing options, SignWell ensures that businesses can access professional e-signature features without exceeding their budget. Transparent pricing helps you focus on getting work done efficiently.

Enhance Your QuickBooks Experience with Seamless E-Signature Integration

QuickBooks Online remains an excellent choice for businesses seeking comprehensive cloud-based accounting software with extensive features and integration capabilities. Its financial management tools are robust, user-friendly, and continuously improving.

The platform’s main limitation has always been the lack of native e-signature functionality for remote document workflows. SignWell finally addresses this gap as the first native integration specifically designed for QuickBooks Online users.

Complete your QuickBooks Online setup with the e-signature capabilities it was always meant to have.

Get documents signed in minutes.

Simple, secure, affordable eSignatures

by  .

.

Get Started Today

businesses served

customer support satisfaction

documents signed