Quick Summary

This article highlights the 7 best e-signature platforms for insurance providers, comparing features like compliance, automation, and integration options. If you’re managing policy sign-offs, client onboarding, or internal approvals, these tools can help streamline your workflow and ensure secure, legally binding signatures.

Looking For The Best E-Signature Platform For Insurance Teams?

The insurance industry is powered by signatures—and e-signatures have made the process faster, more secure, and easier than ever before.

Studies have found that eSignatures reduce the time to complete insurance-related tasks by an average of 27% and lead to an average reduction in turnaround time of 80%. Not to mention benefits like reduced fraud risk, improved record keeping, and enhanced compliance.

But to take advantage of these benefits, you’re going to need a great e-signature tool. In this SignWell guide, we review the top five options for insurance companies to choose from.

Let’s get started.

Why Listen To Us?

At SignWell, we’ve helped 65,000+ businesses streamline their signing processes through intuitive e-signature technology. With our expertise, we’ve identified the best tools for insurance companies to create a seamless signing process for their clients.

But first…

What Are Insurance E-Signature Platforms?

Insurance e-signature platforms are e-signature platforms with features that make them a great fit for the insurance industry.

What are those features? There are a few that are especially important:

- Security

- Compliance

- Integration

… more on those in a bit.

In addition to these features, insurance e-signature platforms also have all of the more general capabilities of e-signature platforms. These include the ability to send, sign, and store documents digitally, automate workflows, and track document statuses.

Benefits of Using Insurance E-Signature Platforms

Cost Savings

Businesses transitioning from traditional paper-based processes to e-signature platforms can experience substantial cost savings, ranging from 55% to 78.62%. These savings include materials, administration, shipping, and subscription costs.

Enhanced Efficiency and Productivity

Efficiency is a major concern for insurance companies—and eSignatures can greatly improve it. By eliminating the need for paper documents and manual processes, document turnaround times can be reduced by up to 80%.

Improved Customer Experience

Organizations that adopt electronic signatures experience a staggering 500% boost in customer loyalty. Additionally, a 2021 study found that 53% of businesses use online signing to enhance stakeholder experiences.

Top 7 Insurance E-Signature Tools

| Platform | Starting Price (Monthly) | Free Trial / Plan | Avg. Rating (G2) | Best For |

| SignWell | $12/month | ✅ Free plan (3 docs/month) | ⭐ 4.8/5 | Cost-effective, legally binding signatures with document routing and audit trails |

| Concord | ~$399/month | ❌ No Free plan | ⭐ 4.3/5 | Managing contracts across legal and insurance teams |

| Adobe Acrobat Sign | $14.99/month | ✅ 14 days | ⭐ 4.4/5 | Enterprise-ready eSignatures with Adobe PDF workflows |

| Ironclad | Custom Pricing | ✅ 14 days | ⭐ 4.5/5 | Enterprise teams requiring advanced CLM, automation, and AI |

| Dropbox Sign | $15/month | ✅ 30 days | ⭐ 4.7/5 | Individuals and teams prioritizing ease of use and Dropbox integration |

| DocuSign | $15/month | ✅ 30 days | ⭐ 4.5/5 | Enterprises needing extensive integrations and advanced agreement workflows |

| PandaDoc | $35/month | ✅ 14 days | ⭐ 4.7/5 | Sales, marketing, and HR teams are in need of robust document design and eSignatures. |

HTML Table

| <table border=”1″ cellpadding=”8″ cellspacing=”0″>

<thead> <tr> <th>Platform</th> <th>Starting Price (Monthly)</th> <th>Free Trial / Plan</th> <th>Avg. Rating (G2)</th> <th>Best For</th> </tr> </thead> <tbody> <tr> <td>SignWell</td> <td>$12/month</td> <td>✅ Free plan (3 docs/month)</td> <td>⭐ 4.8/5</td> <td>Cost-effective, legally binding signatures with document routing and audit trails</td> </tr> <tr> <td>Concord</td> <td>~$399/month</td> <td>❌ No Free plan</td> <td>⭐ 4.3/5</td> <td>Managing contracts across legal and insurance teams</td> </tr> <tr> <td>Adobe Acrobat Sign</td> <td>$14.99/month</td> <td>✅ 14 days</td> <td>⭐ 4.4/5</td> <td>Enterprise-ready eSignatures with Adobe PDF workflows</td> </tr> <tr> <td>Ironclad</td> <td>Custom Pricing</td> <td>✅ 14 days</td> <td>⭐ 4.5/5</td> <td>Large enterprises requiring advanced CLM, automation, and AI</td> </tr> <tr> <td>Dropbox Sign</td> <td>$15/month</td> <td>✅ 30 days</td> <td>⭐ 4.7/5</td> <td>Individuals and teams prioritizing ease of use and Dropbox integration</td> </tr> <tr> <td>DocuSign</td> <td>$15/month</td> <td>✅ 30 days</td> <td>⭐ 4.5/5</td> <td>Enterprises needing extensive integrations and advanced agreement workflows</td> </tr> <tr> <td>PandaDoc</td> <td>$35/month</td> <td>✅ 14 days</td> <td>⭐ 4.7/5</td> <td>Sales, marketing, and HR teams in need of robust document design and eSignatures</td> </tr> </tbody> </table>

|

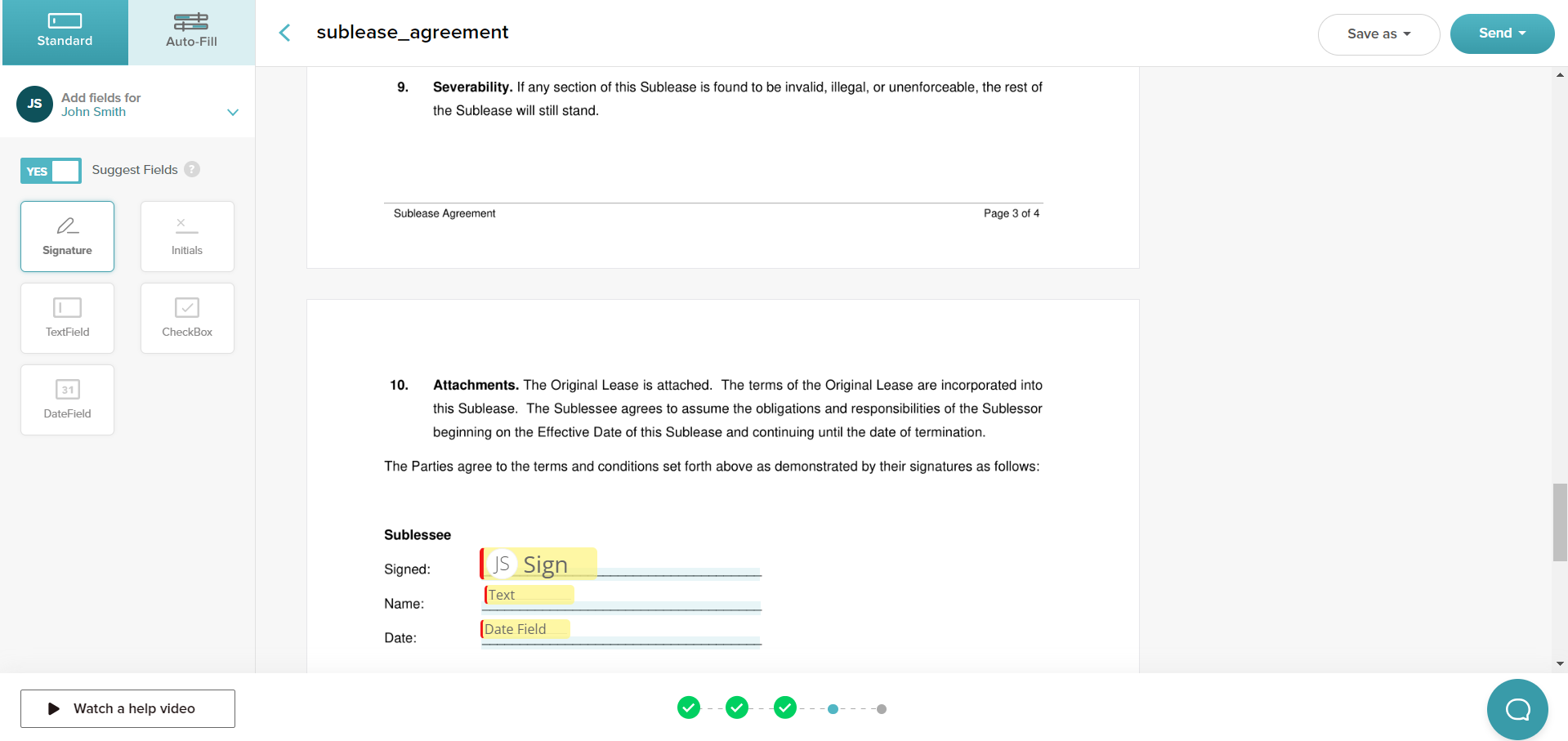

1. SignWell

SignWell is an intuitive but powerful e-signature solution that helps insurance companies slash turnaround times and improve customer experiences.

With SignWell, you can easily upload, set up, and send documents for e-signature in minutes—just drag and drop fields to the designated areas for signing. Plus, you can track document statuses in real time, with notifications when a document is opened, signed, or completed.

SignWell also integrates with 5,000+ tools and apps through Zapier, including:

- Dropbox

- Salesforce

- Airtable

- Pipedrive

…and more.

This (combined with SignWell’s native automation features) makes it easy to streamline your workflows and keep everything in one place.

Key Features

- Compliant eSignatures: Signatures are legally binding in the US and internationally thanks to strict compliance with eIDAS, ESIGN, UETA, SOC 2 Type II, GDPR, HIPAA, and more.

- E-Signature API: Allows users to easily integrate electronic signature functionality into their apps or systems.

- Audit Trail: Provides a detailed account of document access and alterations by logging information such as time stamps, IP addresses, and actions taken.

- Advanced Security: SignWell uses 256-bit SSL encryption to ensure the security of all documents and data.

- Workflow Automation: Set signing orders, automate notifications and reminders, and integrate with third-party tools and systems to minimize manual work.

- Templates: Create and customize templates for common documents to cut document setup time.

- Mobile-Friendly: Let signers sign documents on-the-go with our mobile-friendly interface that’s accessible from any device—no downloads or signups required.

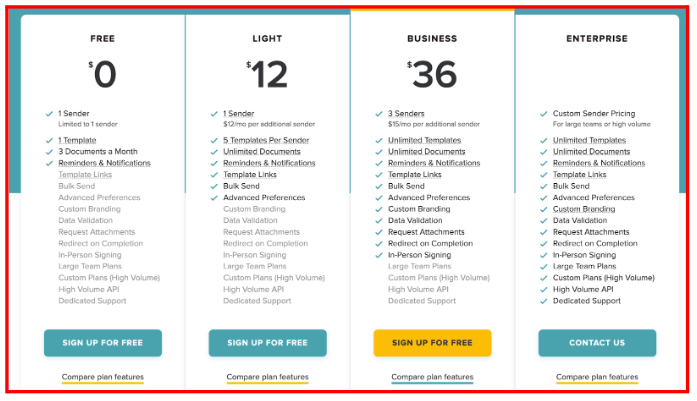

Pricing

Our paid plans include:

- Light ($12/month): Includes 1 sender, 5 templates, unlimited documents, and features like bulk sending and automated reminders.

- Business ($36/month): Includes 3 senders (additional senders cost $8/month each), unlimited templates and documents, and features like data validation, attachments, and in-person signing.

- Enterprise (custom): A fully customizable plan that comes with nice extras like high-volume API access, dedicated support, and large team plans.

Our API is pay-as-you-go, with your first 25 API documents free each month.

Pros

- Ensures compliance with U.S. and international e-signature laws.

- Designed for a simplified e-signature experience.

- Offers affordable pricing plans.

- Multiple customizable templates expedite document processing.

- Seamlessly integrates with over 5,000 popular apps and tools.

Cons

- Limited features in the free plan

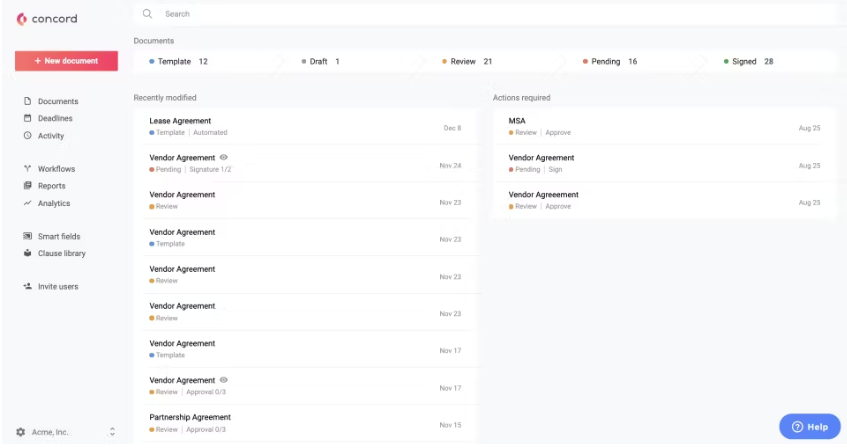

2. Concord

Concord is a contract management platform that offers e-signing as a native feature. The platform supports important features like bulk signing, signing orders, and integrations with tools like Salesforce and Google Drive to automate your signing process.

Key Features

- Easy Collaboration: Work on documents collaboratively via Concord’s editor to avoid confusing back-and-forths.

- Legally Binding: Signatures are legally binding in over 150 countries thanks to compliance with international e-signing laws.

- Unlimited eSignatures: Send and sign an unlimited number of documents without any additional fees.

- Integrations: Integrates with popular tools like Salesforce, Google Drive, and Microsoft Word for seamless document processing.

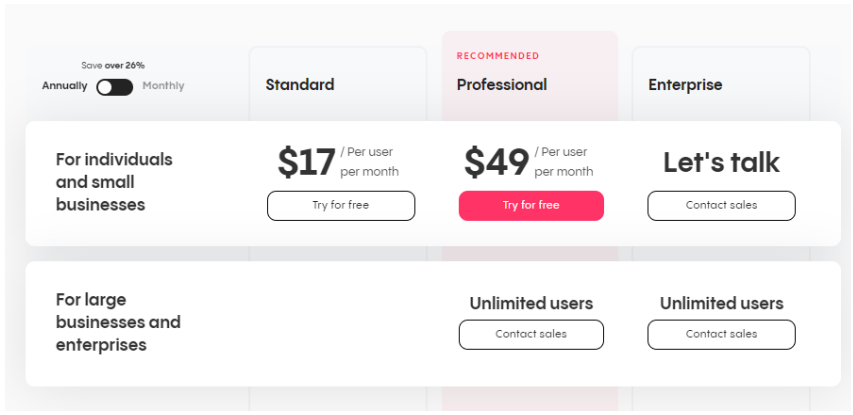

Pricing

Concord offers three plans: Standard ($17/user/month), Professional ($49/user/month), and Enterprise (custom).

Pros

- E-signing is faster and can be done remotely

- Legally binding in most jurisdictions

- Ensures bank-level security

- Unlimited eSignatures

Cons

- Limited customization

- Limited workflow automation

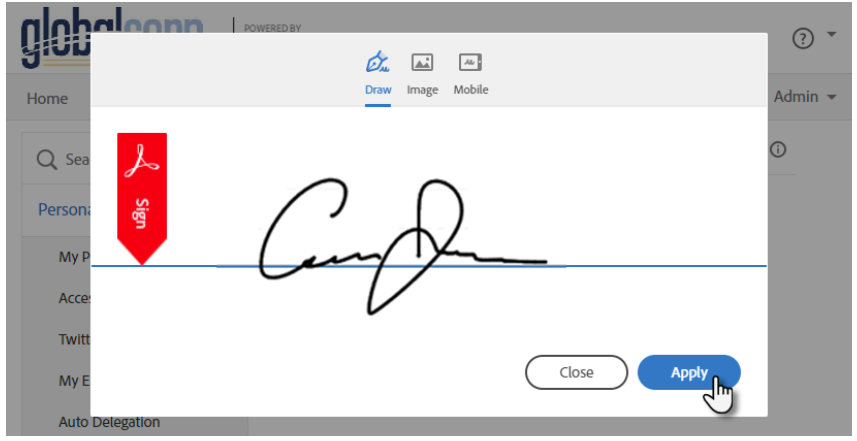

3. Adobe Acrobat Sign

Adobe Acrobat Sign is an e-signing tool that comes packaged with Adobe Acrobat—the popular PDF creator and editor. It features a flexible configuration process that can comply with a wide range of international and industry-specific standards.

Acrobat Sign also has a great set of e-signing features under the hood, from bulk sending to payment processing.

Key Features

- Tracking and Management: Get real-time visibility into the status of your documents and track them as they move through the signing process.

- Customizable Workflows: Design and customize your e-signature workflows to fit your specific business needs.

- Mobile-Friendly: Acrobat Sign is optimized for use on mobile devices, making it convenient for users to sign documents on the go.

- Collect Payments: Collect payments from signers securely and easily with integrated payment processing options.

Pricing

The cost of Acrobat Sign varies based on the plan you choose and the number of licenses you need.

For individual users, it’s included in Acrobat for $12.99/month and Acrobat Pro for $19.99/month with an annual commitment. Teams and businesses can access the tool for $14.99 to $23.99/user/month with an annual commitment. Custom solutions are also available for enterprises seeking additional features and integrations.

Pros

- User-friendly for both regular users and administrators

- Seamless integration with Microsoft apps, Salesforce, and Workday

- Ideal for remote work

- Offers helpful and knowledgeable customer support

Cons

- Users transitioning from trial to licensed products may encounter bugs

- The platform is expensive as an e-signing tool

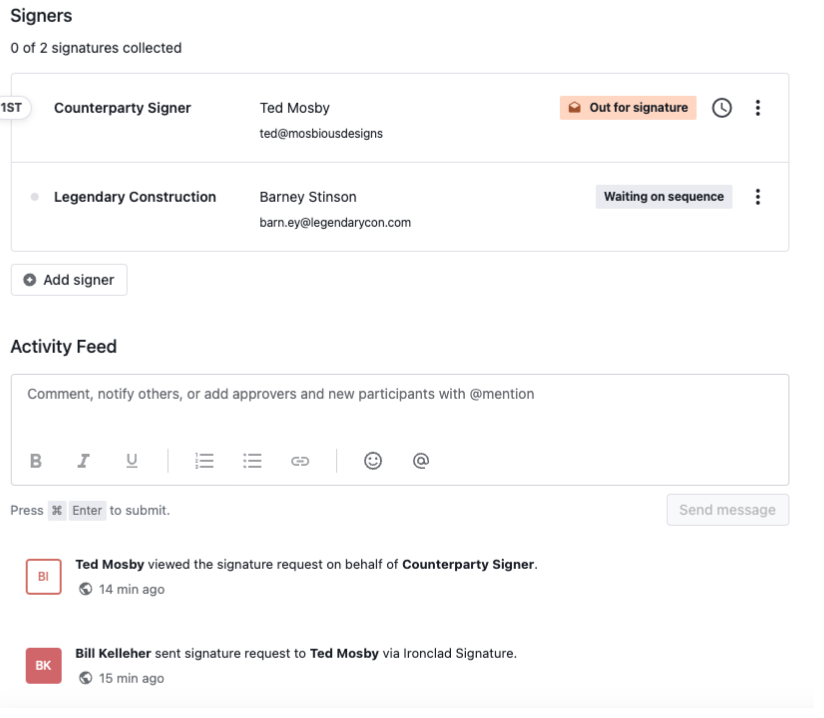

4. Ironclad

Ironclad is a contract lifecycle management (CLM) platform with a product called Clickwrap that offers an alternative to e-signing. Clickwrap offers version control for policies and terms, enables one-click acceptance on any device, and records evidence of user agreement.

Key Features

- One-Click Agreement: Collect legally binding agreements on any device with a single click or tap.

- Version Control: Serve the right contract to the right user at the right time with advanced versioning.

- Snapshots: Collect evidence of agreement that includes user identity, time stamp, and more.

- Contract Management: Easily add or update contracts and terms with an intuitive interface.

Pricing

Contact sales for a quote.

Pros

- Suitable for a wide range of insurance and financial services providers

- Facilitates collaboration

- Great security features

- Automatically generates accurate audit trails

Cons

- Clickwrap agreements don’t work for every insurance use case

- No native features for standard e-signing

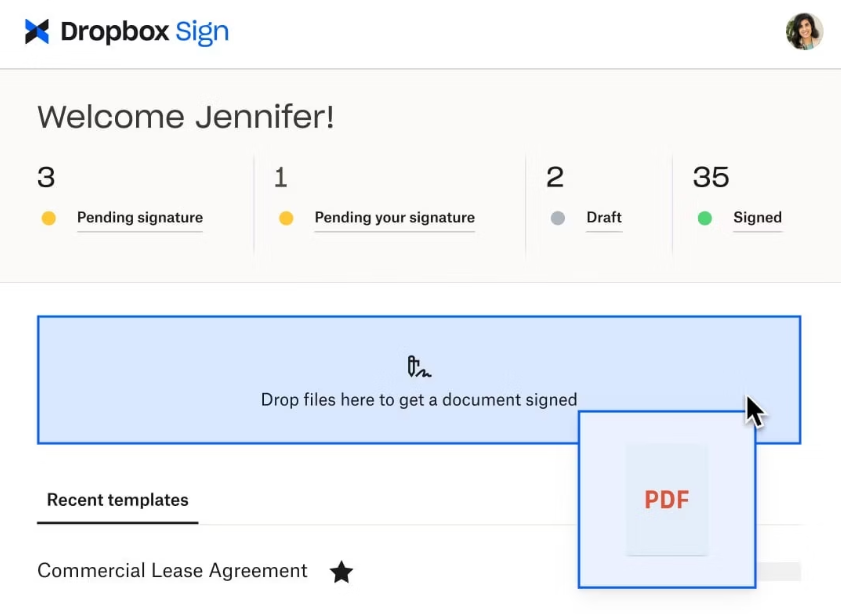

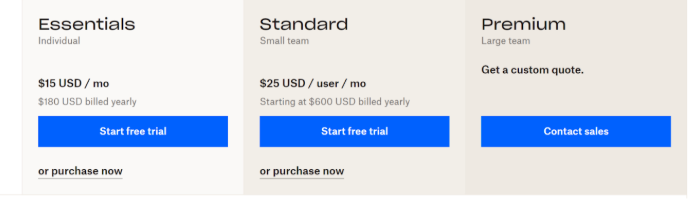

5. Dropbox Sign

Dropbox Sign (formerly HelloSign) is an e-signature platform that’s embedded in Dropbox’s document management tool. It offers a well-rounded set of features like document signing, templates, and audit trails.

Dropbox Sign’s key strength is its native integration with Dropbox—it’s a convenient choice if your business already uses Dropbox to manage contracts.

Key Features

- Document Templates: Simplify the signing process by creating templates for commonly used documents.

- Multiple Signers: Send a document to multiple signers and specify the order in which they should sign.

- Audit Trails: Automatically track every step of the signing process, including timestamps and signer IDs.

- Automated Reminders: Set reminders for signers who haven’t completed their documents yet.

Pricing

Dropbox Sign has three standalone plans—Essentials ($15/month), Standard ($25/user/month), and Premium (custom).

It’s also available through some Dropbox plans.

Pros

- Delivers functionality without unnecessary complications

- Facilitates swift contract signing

- Seamlessly integrates with various platforms

- Bank-level security

Cons

- Certain users have experienced challenges with auto-billing

- Some users are unhappy with the customer support provided

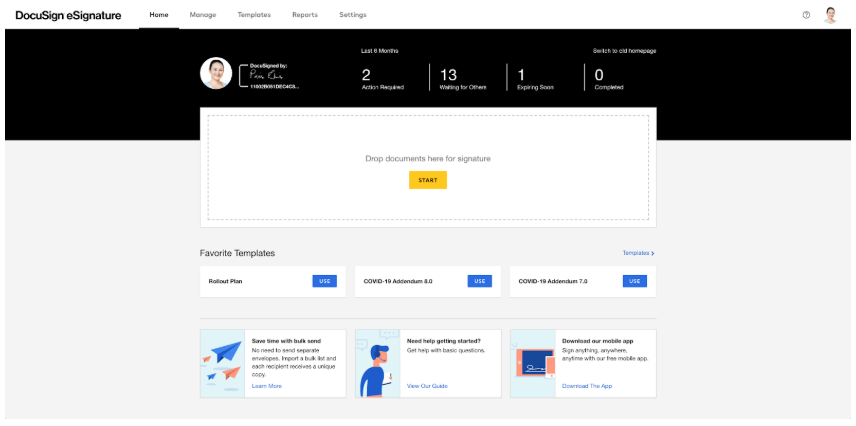

6. DocuSign

DocuSign is one of the most widely adopted e-signature platforms globally. Known for its flexibility and scalability, it serves everyone from solo professionals to large enterprises across industries. Users can securely send, sign, and manage documents from anywhere, making it ideal for teams with remote or distributed workflows.

Key Features

- Integrations: Connects with 400+ apps, including Salesforce, Google Workspace, and Microsoft 365.

- Payment Collection: Collect payments at the time of signing, ideal for contracts, invoices, and service agreements.

- Audit Trail: Automatically records every action with timestamps, IP addresses, and signer details for full transparency.

- Signer Authentication: Verify signer identity using SMS codes, access codes, or knowledge-based authentication (KBA).

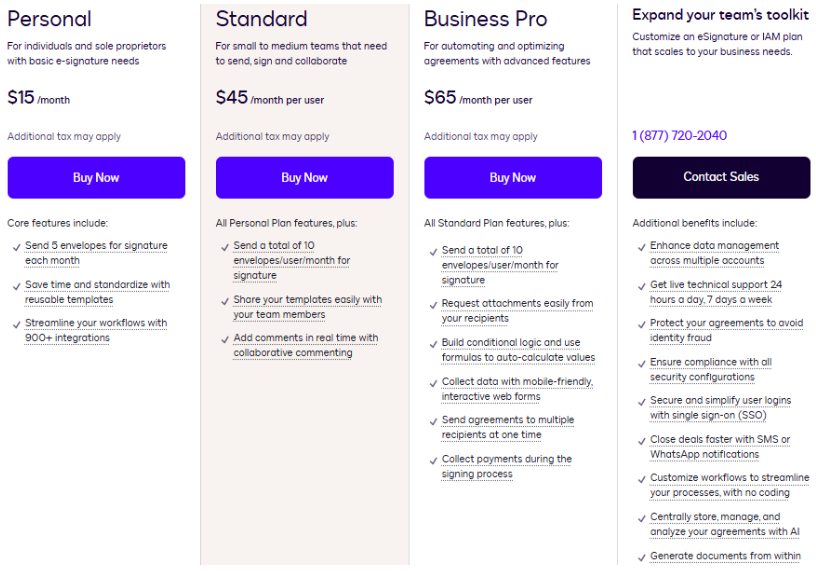

Pricing

- Personal ($15/month): For individuals with basic e-signing needs

- Standard ($45/user/month): Ideal for small to mid-sized teams that need to send, sign, and collaborate on documents

- Business Pro ($65/user/month): Adds advanced features for automating and optimizing agreement workflows

- Enhanced Plans (Custom): Tailored for large organizations with custom workflows and enterprise-level support

Pros

- Integrates with 400+ tools like Salesforce, Google Workspace, and Microsoft 365

- Allows payment collection during the signing process

- Complies with SOC 2, HIPAA, ISO 27001, and eIDAS standards

- Scales easily for large teams and complex workflows

Cons

- Key features like payment collection and advanced fields are locked behind higher tiers.

- Limited branding customization unless you’re on enterprise plans.

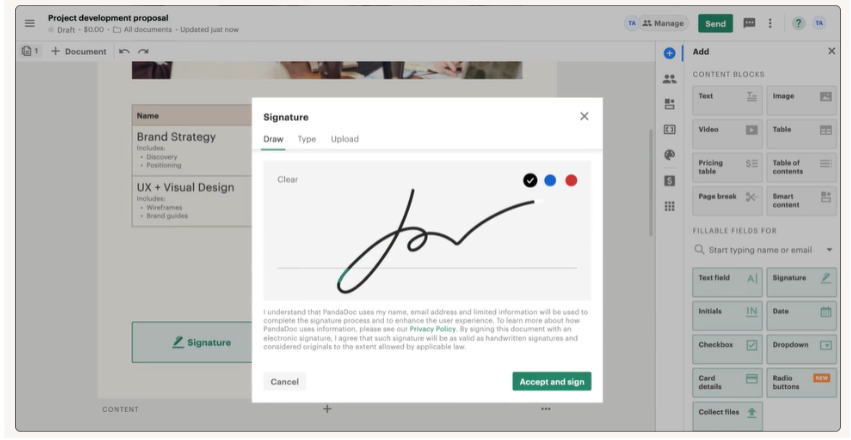

7. PandaDoc

PandaDoc is a cloud-based document automation platform built for fast-growing teams. It helps you create, manage, and sign digital documents, such as proposals, quotes, and contracts, all in one place. By eliminating manual tasks, PandaDoc speeds up workflows and makes it easy to create professional, legally binding documents in minutes.

Key Features

- Conditional Fields: Automatically show or hide sections of your document based on how recipients respond.

- Bulk Sending: Send lots of personalized documents at once using CSV uploads or shareable signing links.

- Built‑in E‑Signing with Certificates: Collect legally binding electronic signatures backed by digital certificates and identity verification.

- Payment Collection: Add secure payment options directly into your documents, allowing clients to pay via ACH transfer or credit card at the time of signing.

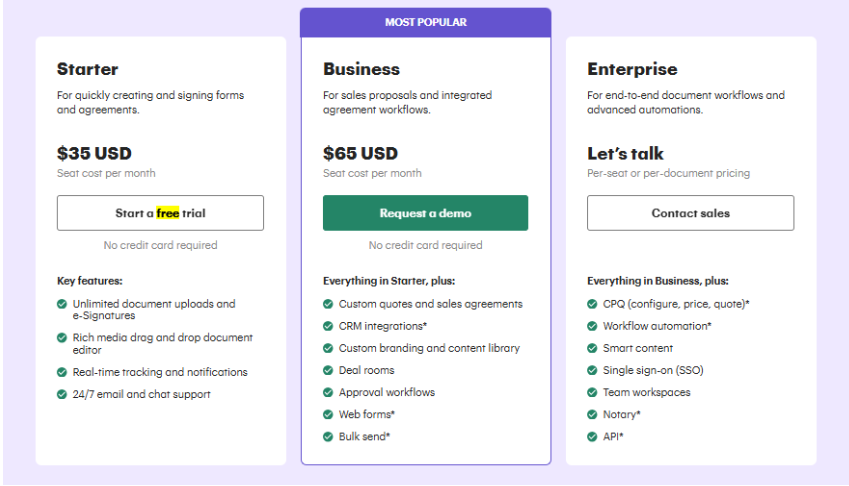

Pricing

- Starter ($35/seat/month): Ideal for creating, sending, and signing basic forms quickly and easily.

- Business ($65/seat/month): For teams managing integrated agreement workflows.

- Enterprise (Custom pricing): Tailored for organizations needing full document automation and advanced workflow capabilities

A 14-day free trial is available.

Pros

- Built-in legally binding eSignatures with audit trails

- Accept payments directly within documents via credit card or ACH

- Real-time document tracking and analytics.

- Automates workflows with conditional fields and approval routing

Cons

- Higher pricing compared to simpler e-signature tools, especially for small teams.

- Branding customization is somewhat limited unless you’re on an enterprise plan.

Criteria for Choosing an Insurance E-Signature Platform

Security

Insurance fraud is a major problem. The FBI estimates that the average US family pays $400 to $700 per year in insurance premiums to offset fraudulent claims. E-signature tools must have advanced security features to protect sensitive information and prevent fraud. Look for platforms that offer multifactor authentication, end-to-end encryption, and audit trails.

Compliance

Insurance companies are subject to strict regulatory requirements, like HIPAA, SOC 2, and GDPR.

When choosing an e-signature solution, make sure it’s compliant with all necessary regulations to avoid any legal issues.

Integrations

Insurance companies use tons of different tools—CRMs, compliance platforms, quoting tools, document management systems… the list goes on. Look for e-signature solutions that offer easy integration with the tools you already use to streamline your processes.

How to Choose The Right Insurance E-Signature Platform

1. Support for Complex Insurance Documents

Look for a platform that handles multi-page forms, policy agreements, claims, and disclosures with ease. It should support PDF uploads, form fields, and conditional logic to streamline paperwork.

2. Compliance with Insurance Regulations

Choose a platform that aligns with the legal and regulatory standards required in the insurance industry, especially when handling health or financial documents. SignWell is fully compliant with ESIGN, UETA, eIDAS, HIPAA (for health insurance), and FINRA (for financial documents), offering legally binding signatures with detailed audit trails.

3. Multi-Party and Sequential Signing Capabilities

Insurance documents often involve multiple signers, agents, underwriters, clients, and beneficiaries. Your platform should support both simultaneous and sequential signing workflows with proper routing.

4. Integration with Agency and Carrier Systems

The platform should integrate seamlessly with your AMS (Agency Management System), CRM, document management tools, and insurance carrier portals to reduce manual data entry. SignWell integrates with over 5,000 apps via Zapier and also provides a flexible API for custom integrations, making it easy to automate document workflows and reduce manual work.

5. Data Security and Encryption

Choose a platform that uses bank-grade encryption (such as AES-256) to protect sensitive data. It should also include secure data storage, regular security audits, and multi-factor authentication. These features ensure that client and policyholder information stays confidential and compliant.

Conclusion

eSignatures are revolutionizing the insurance industry, but not all e-signature platforms are created equal. The five tools reviewed above are great starting points as you explore your options and choose the best one for your business.

Looking for an affordable, intuitive, and fully featured e-signing tool? SignWell offers powerful features, including customizable templates, unlimited documents, and advanced security measures to make sure your contracts are signed securely and efficiently.

Sign up for a free trial and experience the benefits firsthand.

Get documents signed in minutes.

Simple, secure, affordable eSignatures

by  .

.

Get Started Today

businesses served

customer support satisfaction

documents signed