Quick Summary

This guide shows you how to set up QuickBooks for manufacturing including inventory tracking, BOMs, and production costs. Plus, how to integrate SignWell for faster document approvals as SignWell helps businesses streamline operations and configure QuickBooks for complex workflows. With the right setup, you’ll save time and avoid costly errors. Follow our guide and explore our blog for more business accounting tips.

Considering QuickBooks for Manufacturing?

Trying to manage manufacturing operations with QuickBooks can be a challenge. Originally designed for service industries, QuickBooks wasn’t built to handle the complexities of tracking production costs, managing inventory, or creating a bill of materials (BOM). If you’ve struggled with these tasks, you’re not alone.

Many manufacturers believe they need expensive ERP systems, but that’s not always the case. With the right setup and pricing plan, QuickBooks can support your manufacturing workflows. In this SignWell guide, we’ll walk you through how to streamline your manufacturing accounting and speed up document approvals by integrating with SignWell.

Why Listen to Us?

We’ve worked closely with manufacturers using QuickBooks and over 65,000 businesses to manage everything from raw material purchases to production tracking and documentation. Across small shops and growing operations, we’ve seen what works and what causes confusion and reporting errors.

What Makes QuickBooks the Smart Choice for Manufacturing Operations

Manufacturing involves complex tasks like managing raw materials, tracking labor costs, and coordinating with vendors, but QuickBooks simplifies these challenges with essential accounting tools and features designed for manufacturing workflows.

Here’s why it works well for production teams:

- It Tracks Raw Materials, WIP, and Finished Goods: QuickBooks supports real-time inventory tracking so you always know how much stock you have, what’s in production, and what’s ready to ship.

- It Supports Accurate Job Costing: Assign costs by job or product line, including materials, labor, and overhead. This helps you price products confidently and track profit margins at a granular level.

- It Automates Purchase Orders and Vendor Bills: QuickBooks lets you manage vendor relationships and track POs, invoices, and payments all in one place, cutting down on errors and delays in your supply chain.

- It Has Built-in Sales and Financial Reporting: Generate reports like Profit & Loss by Job, Inventory Valuation, and COGS summaries with just a few clicks. These reports help you catch issues early and make informed production decisions.

- It Integrates with Workflow Tools Like SignWell: With SignWell integration, you can collect signatures on vendor contracts, production change orders, and purchase approvals, without slowing down your operations.

QuickBooks may not be a full ERP, but when configured properly, it gives small and mid-sized manufacturers the control and visibility they need to grow.

How To Get Started With QuickBooks for Manufacturing

Step 1: Choose the Right QuickBooks Version & Set Up Your Chart of Accounts

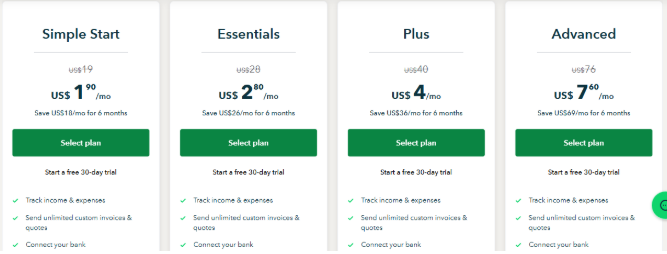

Before doing anything else, choose the version of QuickBooks that matches your manufacturing needs.

- QuickBooks Desktop Premier or Enterprise is ideal for manufacturers. It includes features like sales orders, inventory assemblies (BOM), and job costing.

- QuickBooks Online is easier to access remotely but may require third-party inventory and job costing apps for full functionality.

To get started:

- Go to the QuickBooks website.

Choose your plan and start a free trial or subscription.

- Install the software (for Desktop) or set up your Online company file.

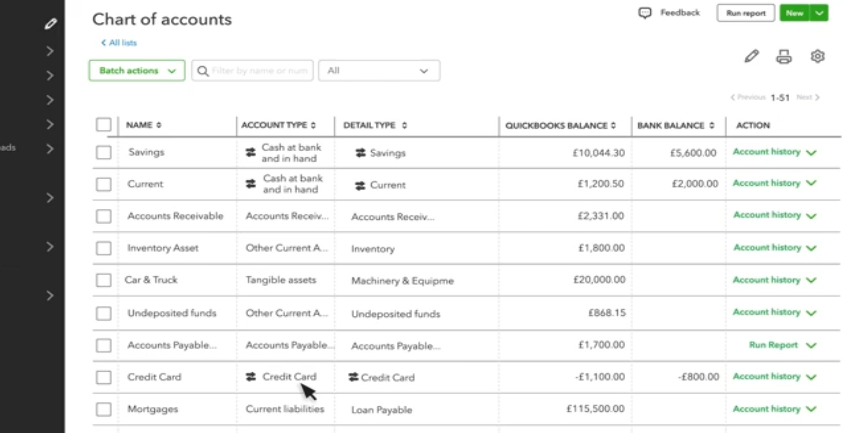

Next, configure your chart of accounts to reflect key manufacturing activities:

- Raw Materials Inventory

- Work in Progress (WIP)

- Finished Goods Inventory

- Direct Labor

- Manufacturing Overhead

- Cost of Goods Sold (COGS)

This setup ensures accurate reporting and inventory tracking later on.

Step 2: Enable Inventory Tracking

Go to Settings > Account and Settings > Sales, and turn on inventory tracking. This lets QuickBooks adjust stock levels automatically when you buy or sell products.

For QuickBooks Desktop (Premier or Enterprise), use the Advanced Inventory feature to enable inventory tracking. Go to Edit > Preferences > Items & Inventory > Company Preferences, and check Inventory and purchase orders are active. You can also enable FIFO costing and track multiple inventory sites.

Clear inventory tracking is essential to maintaining accurate stock levels, whether you’re selling raw materials or finished goods.

Step 3: Build Out Your Product List and Bills of Materials

Create product and service items for:

- Raw materials.

- Sub-assemblies.

- Finished goods.

In QuickBooks Desktop, you can create inventory assemblies to define a bill of materials (BOM). Each time you build an item, QuickBooks deducts materials and adds finished stock.

Step 4: Set Up Vendors, Purchasing, and Sales Workflows

Vendors & Purchasing:

- Add vendors to your QuickBooks account

- Create purchase orders and enter bills when materials arrive

- Use vendor terms to manage payment timelines and discounts

Sales Orders & Invoicing:

- QuickBooks Desktop: Enable Sales Orders under Preferences > Sales & Customers

- QuickBooks Online: Use Estimates or integrate a third-party app for sales orders

Sales orders help you plan production based on incoming demand, even before invoicing.

Step 5: Use Job Costing and Classes to Track Production

Assign jobs or customers to expenses, time entries, and payroll. Turn on Class Tracking to tag transactions by department, product line, or team.

This gives you detailed insight into where your money is going and where you’re profitable.

Step 6: Generate Reports for Manufacturing Insights

Use reports like:

- Inventory Valuation Summary.

- Profit & Loss by Job.

- Sales by Product/Service.

- COGS by Ite.

Customize and export reports to stay on top of margins, stock levels, and cash flow.

Step 7: Integrate QuickBooks with SignWell for E-Signature Workflows

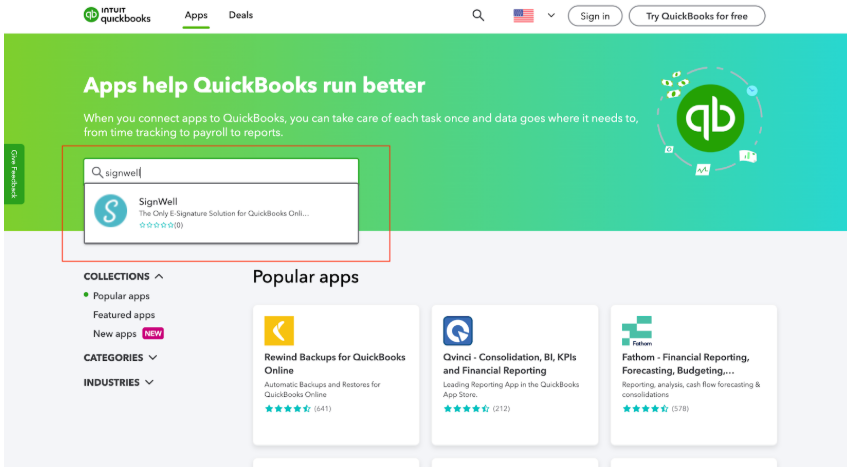

QuickBooks is a powerful tool for manufacturing, but it doesn’t support built-in e-signatures. By integrating SignWell with QuickBooks Online, you can send documents for signature directly from your QuickBooks account and get approvals faster, without leaving your workflow.

You can also create templates in SignWell for frequently used documents to save time and ensure consistency.

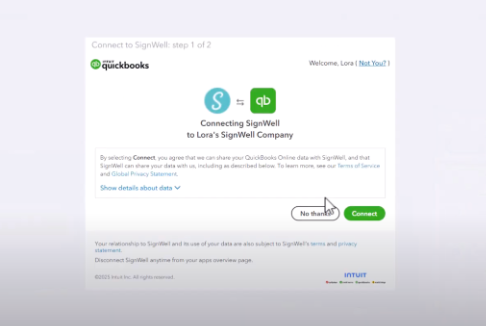

- Connect SignWell to QuickBooks

- First, create a free SignWell account if you do not already have one.

- Go to the QuickBooks App Store and search for “SignWell”

- Click “Get App Now”

- Sign in with your QuickBooks Online credentials

- Authorize the connection to securely link your SignWell and QuickBooks accounts

- Set Up Your Document Workflow

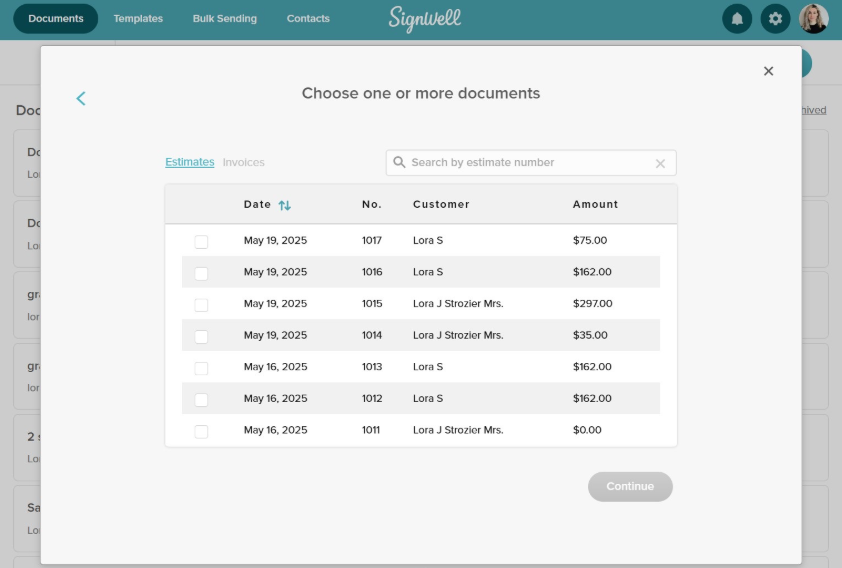

Once connected, SignWell automatically syncs with QuickBooks to streamline your approval process:

- Select the types of documents you want to send for signature, like estimates, purchase orders, or vendor agreements

- Contact details (e.g., name, company, email) are auto-filled from your QuickBooks records

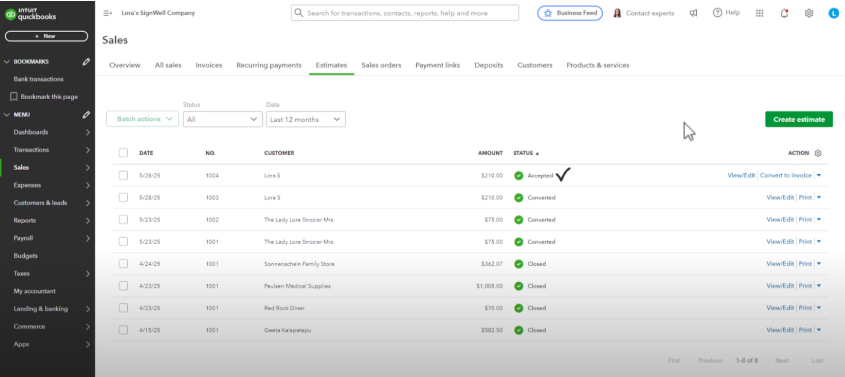

- After a document is signed, you can convert it into an invoice in QuickBooks, no duplicate entry required

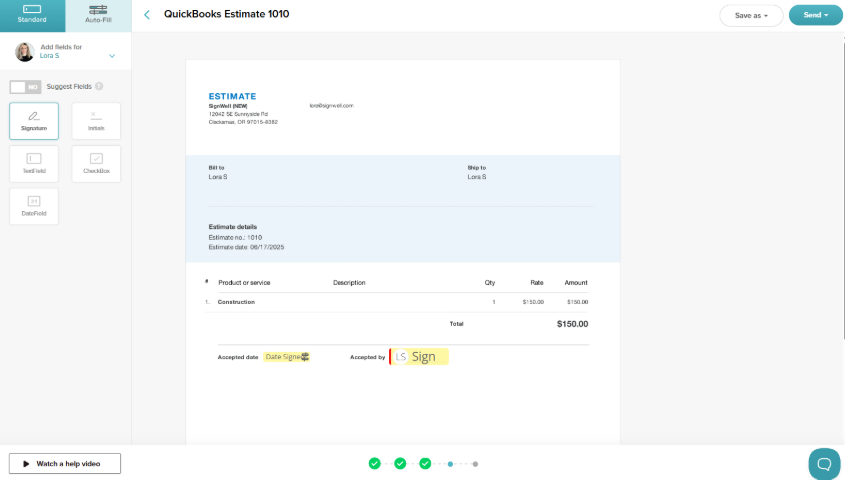

- Send Your First Document for Signature

- Open a document (like an estimate or contract) in QuickBooks Online

- Click “Send for E-Signature with SignWell”

- Add recipients, drag and drop signature fields, and click send

- Your recipient receives a secure email link and can sign from any device

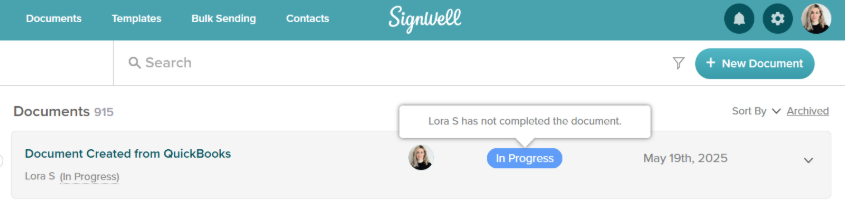

- You’ll get real-time status updates directly in QuickBooks

Top Benefits of Using SignWell with QuickBooks for Manufacturing Workflows

-

Speed Up Purchase Order Approvals

Instead of chasing signatures on paper or email, send POs for e-signature directly from QuickBooks. Approvals are faster, and everything is automatically saved alongside your vendor records.

-

Simplify Vendor and Contractor Agreements

When onboarding suppliers or service providers, use SignWell to send contracts straight from your QuickBooks contacts. Signed agreements are stored securely and linked to your transactions, reducing admin work and risk.

-

Convert Signed Estimates Into Invoices Automatically

Need client approval before manufacturing starts? Send an estimate with SignWell, collect a signature, and turn it into an invoice instantly in QuickBooks, no duplicate entry required.

-

Reuse Templates for Recurring Documents

Create templates for common forms like BOM change requests, vendor terms, or production contracts. Your team can reuse them in SignWell, saving time and ensuring consistency across the board.

-

Track Signatures and Status in Real Time

You’ll never lose track of who signed what. From your QuickBooks dashboard, see exactly when a document was viewed, signed, or still pending, so you can follow up and keep production moving.

Together, SignWell and QuickBooks give manufacturers faster approvals, fewer errors, and a clear audit trail for every signed document tied to your financials.

Best Practices for Using QuickBooks and SignWell for Manufacturing

1. Use Pre-Built Templates for Common Documents

Streamline your manufacturing operations by creating and reusing SignWell templates for frequently used documents like purchase orders, vendor contracts, and bill of materials (BOM) approvals. Pull in client or vendor details automatically from QuickBooks to save time, reduce manual entry errors, and ensure consistent formatting across your entire workflow.

2. Establish Clear Naming Conventions

Create a consistent naming structure across QuickBooks and SignWell to keep everything organized. Use formats like PO_VendorName_Date or BOMChange_ProductName. This makes documents easier to search, sort, and track, especially when you’re reviewing signed agreements or matching them to transactions, inventory logs, or financial reports inside QuickBooks.

3. Schedule Monthly Reviews of Reports and Signed Docs

Dedicate time each month to review your job costing, COGS, and inventory reports inside QuickBooks. At the same time, reconcile signed documents in SignWell to ensure every approval, contract, and PO is correctly accounted for. This dual review process improves financial accuracy and reduces the risk of missed signatures or compliance issues.

4. Automate Approval Rules with Conditional Workflows

Take advantage of SignWell’s approval logic by setting up rules based on document type, vendor, or order value. For example, automatically require dual sign-off for purchase orders exceeding $10,000. These automated workflows reduce delays, maintain compliance, and give you better control over procurement and vendor engagement, without extra admin overhead.

5. Organize Teams Using SignWell Workspaces

Improve collaboration and data security by creating separate SignWell workspaces for each department, such as production, procurement, and finance. Assign access levels based on roles, so team members can send or approve documents without viewing unrelated or sensitive financial data. This structure aligns neatly with how data flows in QuickBooks.

Run a More Efficient Manufacturing Operation With QuickBooks + SignWell

Managing production is complex enough; your accounting and approval workflows should not add to the chaos. With QuickBooks tracking your inventory, costs, and jobs, and SignWell automating your document approvals, you can focus more on production and less on paperwork.

This integration helps you:

- Eliminate delays in purchase approvals.

- Keep vendor agreements tied to your financial records.

- Convert signed estimates into invoices without re-entering data.

- Maintain a clean audit trail across your entire operation.

If you’re ready to tighten up your back-office process, start by connecting QuickBooks and SignWell. You’ll speed up approvals, reduce errors, and create a smoother path from purchase order to finished product.

Get started with SignWell and see how we streamline approvals for manufacturing and supply chain industries today.

Sign with a team that knows what you need.

Putting a signature on a document shouldn’t be hard. The SignWell mission? Simplify how documents get signed for millions of people and businesses.

Get Started Todaybusinesses served, so far...

total documents signed

customer support satisfaction