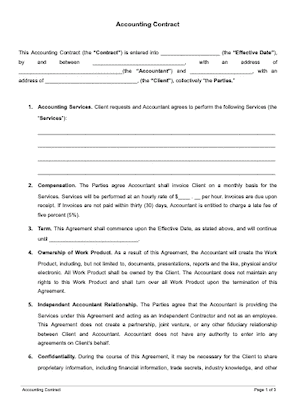

Accounting Contract

Accounting Contract

This Accounting Contract (the “Contract”) is entered into ____________________ (the “Effective Date”), by and between _______________________________, with an address of ___________________________________(the “Accountant”) and _____________________, with an address of _______________________________, (the “Client”), collectively “the Parties.”

Accounting Services. Client requests and Accountant agrees to perform the following Services (the “Services”):

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

Compensation. The Parties agree Accountant shall invoice Client on a monthly basis for the Services. Services will be performed at an hourly rate of $____ . __ per hour. Invoices are due upon receipt. If Invoices are not paid within thirty (30) days, Accountant is entitled to charge a late fee of five percent (5%).

Term. This Agreement shall commence upon the Effective Date, as stated above, and will continue until ______________________________.

Ownership of Work Product. As a result of this Agreement, the Accountant will create the Work Product, including, but not limited to, documents, presentations, reports and the like, physical and/or electronic. All Work Product shall be owned by the Client. The Accountant does not maintain any rights to this Work Product and shall turn over all Work Product upon the termination of this Agreement.

Independent Accountant Relationship. The Parties agree that the Accountant is providing the Services under this Agreement and acting as an Independent Contractor and not as an employee. This Agreement does not create a partnership, joint venture, or any other fiduciary relationship between Client and Accountant. Accountant does not have any authority to enter into any agreements on Client’s behalf.

Confidentiality. During the course of this Agreement, it may be necessary for the Client to share proprietary information, including financial information, trade secrets, industry knowledge, and other confidential information, with the Accountant in order for the Accountant to complete the Services. The Accountant will not share any of this proprietary information at any time. The Accountant also will not use any of this proprietary information for the Accountant's personal benefit at any time. This section remains in full force and effect even after termination of the Agreement by its natural termination or the early termination by either party.

Audit. The Accountant will maintain complete records of all business conducted related to the Services and this Contract. The Accountant’s records will be available for full inspection and audit by the Client and government entities for the period of time required by law.

Termination. This Agreement may be terminated at any time by either party upon written notice to the other party. The Client will be responsible for payment of all the Services performed up to the date of termination, except for in the case of the Accountant’s breach of this Agreement, where the Accountant fails to cure such breach upon reasonable notice.

Upon termination, the Accountant shall return all Client content, materials, and Work Product to the Client at its earliest convenience, but in no event beyond thirty (30) days after the date of termination.

Representations and Warranties. Both Parties represent that they are fully authorized to enter into this Agreement. The Accountant agrees to perform accounting services in accordance with ethics standards set forth by the International Ethics Standards Board for Accountants. All analysis, records, reports, and filings will be performed in compliance with local, state, and federal law.

Indemnity. The Parties each agree to indemnify and hold harmless the other party, its respective affiliates, officers, agents, employees, and permitted successors and assigns against any and all claims, losses, damages, liabilities, penalties, punitive damages, expenses, reasonable legal fees and costs of any kind or amount whatsoever, which result from the negligence of or breach of this Agreement by the indemnifying party and/or its respective successors and assigns that occurs in connection with this Agreement. This section remains in full force and effect even after termination of the Agreement by its natural termination or the early termination by either party.

Limitation of Liability. UNDER NO CIRCUMSTANCES SHALL EITHER PARTY BE LIABLE TO THE OTHER PARTY OR ANY THIRD PARTY FOR ANY DAMAGES RESULTING FROM ANY PART OF THIS AGREEMENT SUCH AS, BUT NOT LIMITED TO, LOSS OF REVENUE OR ANTICIPATED PROFIT OR LOST BUSINESS, COSTS OF DELAY OR FAILURE OF DELIVERY, WHICH ARE NOT RELATED TO OR THE DIRECT RESULT OF A PARTY’S NEGLIGENCE OR BREACH.

Severability. In the event any provision of this Agreement is deemed invalid or unenforceable, in whole or in part, that part shall be severed from the remainder of the Agreement and all other provisions should continue in full force and effect as valid and enforceable.

Waiver. The failure by either Party to exercise any right, power, or privilege under the terms of this Agreement will not be construed as a waiver of any subsequent or future exercise of that right, power, or privilege or the exercise of any other right, power, or privilege.

Legal Fees. In the event of a dispute resulting in legal action, the successful party will be entitled to its legal fees, including, but not limited to its attorneys’ fees.

Legal and Binding Agreement. This Agreement is legal and binding between the Parties as stated above. This Agreement may be entered into and is legal and binding both in the United States and throughout Europe. The Parties each represent that they have the authority to enter into this Agreement.

Governing Law and Jurisdiction. The Parties agree that this Agreement shall be governed by the State and/or Country in which both Parties do business. In the event that the Parties do business in different States and/or Countries, this Agreement shall be governed by ___________________ law.

Entire Agreement. The Parties acknowledge and agree that this Agreement represents the entire agreement between the Parties. In the event that the Parties desire to change, add, or otherwise modify any terms, they shall do so in writing to be signed by both parties.

The Parties agree to the terms and conditions set forth above as demonstrated by their signatures as follows:

Accountant

Signed: _____________________________________

Name: _____________________________________

Date: _____________________________________

Client

Signed: _____________________________________

Name: _____________________________________

Date: _____________________________________